MOST RECENT BLOGS

-

In the midst of a global pandemic, our homes have become much more than a space that provides a roof over our heads. We've experienced sheltering in place for several months, so having a place we can call our own has become invaluable. For many, our homes have also turned into our workspaces and even schools for our children. Moreover, a recent survey by Gallup just ranked real estate as the best long-term investment among several options—with 41 percent of Americans seeing it as superior to stocks, gold, savings accounts, and bonds. But unlike other investment options where the benefits are purely financial, owning a home provides both financial, non-financial, and social advantages that allow every homeowner to take great pride in. As National Homeownership Month kicks off this June, we'll cover some of those benefits that will hopefully make you more excited to kickstart your homeownership journey, or even celebrate if you already have a place to call your own. Building equity Home equity refers to the value of your property that “you truly own.” It is your property's current market value minus the amounts owed on any mortgages or liens against the property. Owning a home builds equity because equity grows with each payment you make toward your mortgage, which brings you closer to owning more of your home. It’s opposed to making monthly payments to your landlord if you’re a renter, where you will own nothing no matter how long you stay there. Performing routine maintenance on your home and other renovations that help increase its resale value is also another way to build equity. Your home equity is a form of forced savings that is essentially part of your net worth, which means you’re preparing for your future since you can use it down the road to help you accomplish other huge financial goals. Helps build a strong credit history A mortgage is considered “good debt” so as long as you're consistently making your monthly loan payments on time, you are showing to other lenders that you are a good borrower. This helps to build your credit and proves your credit-worthiness, which can be helpful when you may want to consider other loans in the future, such as for buying a car, remodelling your home, or getting a business loan. It’s an additional perk that many buyers may not consider at first but will prove to be beneficial later on. Better control and stability over housing-related costs One of the most significant financial benefits of being a homeowner, and the biggest advantage versus being a renter, is that you will have better control over your monthly housing payments. Unlike rent costs that continue to go up each year, you'll have peace of mind knowing that your monthly mortgage payments remain relatively steady despite rising interest rates and periods of inflation, especially if you have a fixed-rate mortgage where the cost of your home is locked in for the term of your loan. Other costs of owning a home like property taxes and insurance premiums may fluctuate, but this doesn’t typically happen as often as rising rents. You can also choose to install energy-efficient appliances and features that can help save you thousands of dollars in utility bills every year. With this kind of control, you can budget accordingly and make better short- and long-term financial decisions. Tax deductions Another financial perk of being a homeowner is that you qualify for many tax deductions and tax credits. To make it clear, a tax deduction reduces your adjusted gross income, which in turn reduces your tax liability. Meanwhile, credits represent money taken off of your tax bill. While we won't elaborate on them further, the most common tax deductions for homeowners include: Mortgage interest Points Real estate taxes Private Mortgage Insurance (PMI) Home office deduction Medically-necessary home improvements Capital gains tax exclusion On the other hand, tax credits may be available for those who were issued a Mortgage Credit Certificate (MCC). You can also check if your state offers tax credits or rebates for energy efficient-improvements you’ve made to your home. Increased privacy and security In the 2020 National Housing Survey from Fannie Mae, one of the top three reasons Americans value homeownership is because it helps them achieve a sense of privacy and security. Unlike when living in an apartment where you often have to deal with thin walls and be able to hear almost every move of your neighbors, you are less likely to experience this when you own a home. You are also more likely to have the same neighbors for many years, increasing trust among the community. Moreover, privacy and security were proven to have become even more valuable as we've dealt with the challenges of the recent health crisis. Freedom and control over your living space Owning a home means you have a space that is uniquely yours. You have the freedom to customize it to your liking; accomplish renovations to make your home look exactly how you want it. In the National Housing Survey mentioned above, 91 percent of respondents said homeownership could help them achieve control over what they do with their living space. Many renters have rules and limitations over the color they can paint the rooms or changes they can make to the appearance of their living spaces to make it feel like home, or even against having pets. But when you own, you're free to create the space you want and renovate how you see fit (but still within the boundaries of your homeowner’s association and local zoning rules). It’s a liberating feeling that can never be taken for granted, especially if you’ve been a long-time renter first before finally owning your space. Increased civic participation Unlike their renter counterparts, homeowners often settle in their area for longer periods and don't have to worry about moving anytime soon. This in turn adds a certain degree of stability to the neighborhood. With their stronger connection to their community, homeowners are often more committed to volunteer work. They are likely to contribute to the maintenance of their properties and surrounding areas. They are also more likely to get involved in community organizations and build relationships with other people in their neighborhood, potentially leading to an overall increase in civic participation. Pride of ownership The feeling of accomplishment and the sense of pride that comes along with homeownership is something that can never be underestimated. In the Fannie Mae survey, 87 percent of consumers believe owning a home is important to “living the good life.” Having a place where you can settle and raise your family, make memories, celebrate holidays and other special occasions, and spend time with family and friends is an important milestone that contributes to your overall health and well-being, which ultimately leads to a better quality of life. This sense of stability and life satisfaction is the reason why homeownership continues to represent the American dream for thousands of families each year.

Read More The Complete Final Walkthrough Checklist

You're almost there. You can’t wait to finally get your house keys and move to this new place you’d call home. You just can’t contain your excitement as the closing day approaches. However, you’ve still got the final walkthrough—your last chance to make sure everything is in place and in the right condition before you sign the paperwork. It’s a critical step in the home buying process so it can be just as nerve-wracking. There’s a lot to keep track of because you want to make sure that the house is exactly in the way you want it to be before it can be called yours. You and your real estate agent's goal is to make the final walkthrough smooth sailing, so here are some tips before you reach the finish line. Phone/camera - Use it to take photos of anything that concerns you or want to take note of. Phone charger - Aside from keeping your phone alive, you can use it to test the electrical outlets around the house. Notepad and pen - They might come in handy when jotting down notes and questions as needed. The home inspection report - You can use it to review the issues flagged by the inspector and check if the seller completed the negotiated repairs. Your home purchase agreement - This is your legally binding contract that lays out the terms agreed upon by both parties of the transaction. The home should be in broom clean condition. All the negotiated repairs have been completed, with proof of receipt validating that the work was taken care of, together with the date. All appliances included in the sale should be clean and functioning properly. All fixtures, such as doorknobs, cabinet handles, etc., should be included and in place unless it was indicated in writing that they will be the property of the seller. If you're buying a new construction home, make sure to look for defects and other cosmetic issues. Open and close all doors and windows and make sure they lock correctly. Test out both heating and cooling using the HVAC system, even if it's freezing or scorching hot outside, and see if they’re working satisfactorily. Turn on and off all the light switches and ceiling fans. Plug your phone charger in every electrical outlet to make sure they’re functional. Inspect all walls, ceilings, and floors to check if there’s any damage or mold that wasn’t there before, especially in spaces where there used to be furniture. Run the garbage disposal. Run the exhaust fans or extractor fans in the kitchen and bathrooms. Test all faucets and the showerhead to make sure they have both hot and cold water. Check the bathrooms and make sure they’re free from any mold, leaks, and water damage. Flush toilets to check for leaks. Test out all garage doors, doorbells, and any smart security systems. Make sure that all garbage, debris, personal belongings, and other items have been removed. Know the people who should attend the final walkthrough with you. Your real estate agent should accompany you and will be your “human checklist” while going through the property. Hopefully, the seller has already moved out so you and your agent can have all the freedom to inspect the home thoroughly and without pressure. The final walkthrough is not a home inspection. It's to make sure that the home is in an acceptable and livable condition, free from any surprise damages that weren’t there when you last saw it. It’s also your chance to make sure all repairs you and the seller agreed in writing have been completed before finally getting your house keys. Don’t get too excited about the idea of having your “new home” just yet. Remember that the final walkthrough is the best time to check every inch of the home and not to think about your would-be sofa placement or the marvelous open floor plan. Practice patience and take your time. Don’t rush. Remember that this is your last chance to give the property a full look over before it’s all yours. Whether it takes a few minutes or more than an hour (depending on the size of the property), don’t shy away from inspecting and verifying all items that need attention. Don’t be tempted to pass on this opportunity! Just because the transaction closing date draws near doesn’t mean you should skip the final walkthrough. It’s never a good idea since many issues can come up and you could end up paying more for a home if you didn’t get the seller to reduce the home’s price as compensation for any neglected repairs.

Read More6 Mistakes to Avoid When Buying Furniture for Your New Home

Selecting and buying furniture for your beautiful abode, whether it be a sofa, dining table or any other piece, is no doubt fun and exciting. Especially if you're a first-time homeowner who finally has the liberty to choose whatever furniture you want to fill your private space with. But before you give your home that desired Pinterest-inspired look or buy an item that’s similar from what you’ve seen online or from your favorite home decor magazine, keep in mind that furniture-buying can also be stressful and overwhelming. It’s probably the next commitment (and investment) you have to make after buying your home since you’ll be using the items for quite a number of years, so it is definitely a huge deal. Unless you want to be stuck with pieces of furniture that don't work for the room or any of your space, steer clear of these top six common mistakes before buying. After all, we all just want to end up with great pieces that will not only make our home beautiful but also make our life more comfortable. 1. Forgetting to measure everything in your space before buying. The last thing you want is to end up with an expensive piece of furniture that won't fit through your front door and through the rest of your doorways and walkways. However, it’s one of the most common mistakes many homeowners make when buying furniture. So here are four crucial things you need to do before bringing home any piece: Measure the height, width, and depth of the furniture you’re considering and see if it’ll fit where you want it. Measure the dimensions of the room where you want to place the furniture, whether it’s the living room, kitchen, bedroom, or even home office. It might be easier if you map out your potential new furniture arrangements. One good method is to stick some masking tape or painter’s tape on the floor to help you visualize the dimensions of the new piece you’re considering. Check if it will fit the doorways and door frames of the room, the narrow part of the hallways, and even staircases and elevators—anything through which you'll be moving your new furniture. Last but not least, add some space to your measurements for people who are carrying the piece, especially if they have to move it through a right-angle corner of a hallway or at a narrower part of a room. Also, don’t forget to write down all your measurements! Forgetting to do these things can be costly, especially if you have to foot the bill to return a piece to the store. Also keep in mind that furniture pieces like sofas and dining tables can look deceptively small in a showroom but could end up big for your home. So measure everything (and double-check your measurements) before you hit the stores to avoid falling in love with furniture that will never fit your space. 2. Not paying attention to scale. Aside from measuring everything, you also need to consider the scale of the product and how much space is needed around it before you bring it home. You want a piece to fit into the space without blocking entryways or foot traffic, or without people needing to squeeze between tightly-packed pieces to be able to have access or move around parts of the home. Likewise, keep in mind how your room will work as a whole and try to keep things in proportion. For an instance, too small a rug can actually make a room look smaller, while a bulky, oversized sofa can be too dominating or overwhelming. Always consider how a particular piece of furniture would go well with the things alongside it rather than outshine everything else. 3. Buying without thinking how your furniture will fit your lifestyle. Another mistake of many new homeowners is buying furniture without taking their lifestyle into consideration. Even if you have chosen the chicest pieces to adorn your home, if they don't work with your lifestyle or family circumstances they could only end up bringing you headaches. For example, if you have children or pets, or planning to have them as you grow your family in the foreseeable future, you might want to select furniture with durable fabrics or upholstery that will resist everyday spills, odors, sharp claws and even muddy paws. Moreso, you might want to think twice before buying a glass coffee table with hard edges, as it could become a hazard especially to toddlers. If you’re someone who loves to host dinner parties among families and friends (although things may be quite different for the meantime due to the pandemic), you may want to select a dining table with an extra leaf. Whatever your lifestyle is, it’s important to consider if the furniture you’re buying will hold up to those uses. Always ask yourself questions like “How will I use this piece of furniture?” or “What about my family circumstances?” This way, there won’t be a need to waste thousands of dollars because you need to replace your things after only a couple of months. 4. Not being realistic about the maintenance. In relation to the lifestyle subject discussed above, you need to be realistic about the normal wear and tear the furniture will be subject to, and assess your willingness to clean and maintain it yourself or pay for professional cleaning instead. Even if you have the budget to buy high-end pieces, they may require more care than what you have anticipated. Buy accordingly and know the type of care needed on each piece of furniture, which is highly dependent on the materials and finishes. Be familiar with how it can be cleaned, and what are the best (and worst) products to clean it with. There are a variety of care products such as waxes, varnishes, polishes, and even fabric cleaners, and many were designed to work on certain materials only. Some cleaning products can also be harsh and easily ruin materials like leather and genuine hardwood. So be sure to know what you are getting into, and only consider a certain material if you feel you're up to the task of keeping on top of its maintenance. 5. Prioritizing style over comfort. With so many beautiful styles and designs to choose from for your sofa, bed, cabinets, or even dining table, it's easier for you to get carried away and buy something that looks great and stylish. But no matter how much you want your home to look like it’s come out from a page of an interior design magazine, remember to be practical and always choose comfort over beauty. No matter how attractive, never get caught up in the aesthetics of any piece. The furniture you choose should be fit for everyday use, and should be both comfortable and serve the purpose it’s intended for, not to mention that you’re going to live with it for years to come. 6. Buying everything at once or getting into impulse buys. You've spent months searching for your dream home. Now that you’ve got your house keys, don’t spend a few hours (or minutes) buying new furniture just because the empty spaces feel lonely. Or maybe you’re already fed up with your old furniture and want everything to be replaced with new ones as soon as possible. No matter how tempting these situations are, don’t rush into buying. It’s a mistake that could eventually lead to overspending because the pieces you bought could end up neither working for your needs and lifestyle nor matching your personality. Remember to plan ahead, think it through, check the measurements, assess your lifestyle, check the fabrics, colors, or materials, and take your time instead of making any impulsive purchases. While getting the perfect piece of furniture may not be possible every time, as long as you’ve seriously considered it and you’re still in love with it even after you’ve slept on the idea, then go ahead and add it to your beautiful home.

Read MoreShould You Renovate or Not? Here Are 3 Things To Consider Before Selling Your House

When thinking about putting their property on the market, homeowners often need to ponder on this question: should they renovate or not before selling? Since it's every home seller’s goal to make sure they get the best price for their biggest investment, it’s important to determine whether you should undertake some remodeling projects or upgrades to make your home more appealing to a bigger pool of buyers. There are several factors to consider before you can figure out whether or not renovating will be worth your time and investment. Before you replace that roof or tear down a wall, here are three things to keep in mind and see what applies to your situation: The first thing to remember is that every property is different. Some homes need only a few cosmetic touch-ups; some need a full kitchen or bathroom renovation, while others need some major repair work on other areas. This is why it's important to assess the current state your home is in. If you own a turnkey or a move-in ready home, there’s little to no need to renovate anything and you can just leave it to the buyers to do what they want once they move. But if it’s in dire need of repairs, you may have to do your part to make it more livable. Consider the current condition of your home before planning any renovation work because you might be surprised by how well your house could fare in your local real estate market. A pre-listing home inspection done by a professional is a good idea so you can be aware of any potential issues, especially structural or electrical problems, pests, and even mold. The home inspector will take a thorough look at the property, and their findings or report will show the significant repairs that need to be done. Another major factor you need to consider is the condition of your local real estate market. It's truly a case-by-case study in the market now as each one is different. If you’re in a buyer’s market where inventory is high or there are plenty of homes for sale but not enough buyers’ interest, you might want to consider taking some time to do the repairs before listing your home for sale. But if you’re in a seller’s market where there are many interested buyers but real estate inventory is low, buyer competition is high so you don’t want to miss the opportunity to sell. Your best move is to just determine which upgrades are truly necessary and will maximize your listing. You can do this with the help of a local real estate agent who can give you a good idea of current market conditions so you’ll figure out if you have the upper hand. When deciding whether or not to renovate your home before you sell, another thing you need to do is to carefully weigh the cost, time, and workload needed for the potential renovations. Because despite any thorough planning and budgeting, costs could run higher than what you may have initially anticipated. This is why you also have to take into account if the proposed improvements are worth it against your home's market value once the repairs are completed. Many sellers think that they’re guaranteed a return on investment and they’ll be able to recoup the costs of such upgrades when they add it to their home’s selling price, but that isn’t always the case. In reality, many remodeling projects hardly ever have an equal ROI. Likewise, remember that renovation takes time. So if you’re in a hurry to move because of a new job or any other reasons, renovations may not be right for you and it might be wiser to sell as-is or just do some minor touch-ups that won’t cost a lot of money but will still improve your home’s aesthetic appeal. Whether or not to renovate before selling your home is one of the major dilemmas that homeowners face. This is why it's critical to contact a local real estate professional to advise you on the matter and see if it’s the best course of action. Since every property and market is different, your local agent will have a walk-through of the home and see if renovating will be worth the time, effort, expenses, and risks. Because oftentimes, your home will still sell great even if you don’t do any major renovations, especially if there aren’t enough homes for sale in the market. In this case, your agent will just advise you to conduct deep cleaning and some cosmetic repairs to make the home more appealing to potential buyers, instead of spending a lot of money that might not yield a good return on investment. You can count on your realtor’s expertise to determine which improvements are truly necessary, and which ones are not likely to be deal-breakers for buyers, especially for those that are specifically looking for fixer-uppers.

Read MoreThe Risks of Buying A Home With Unpermitted Renovation Work

When you're on a search for your dream home, it’s easy enough to fall in love with any renovated features, such as a remodeled kitchen or bathroom, a finished basement, or a newly-installed deck, that are set to make your life more comfortable once you take over as the owner. However, those lovable features can easily turn into expensive nightmares when they turn out to be unpermitted work, and there’s no paper trail showing such improvements were done with proper authorizations. To save yourself from any trouble as early as you can in the process, we've laid out the risks associated with buying a home with work done without a permit, and how you can protect yourself as a buyer. Your potential home might be your biggest financial investment, after all. Unpermitted work is a term that applies to any modifications or construction on a home that does not carry the necessary permits to make it legal. Building codes and permit requirements vary with every city or town, so what might require a permit in one place may not in another. When buying a home, you can check on the property disclosure statement provided by the seller and see the list of things the current owners have done to the property during ownership, including any work done without a permit. You can also call or visit the local building department for more information and see if the owners pulled permits. In some municipalities, the status of permits can also be checked online. Many HOAs or homeowners associations often like to have permits on file as well, so you can try asking them to see permit records on the property you're looking at. Getting permits for any home improvement that requires it is vital, especially if it involves any electrical, plumbing, or structural work. And yet, many homeowners forgo the permitting process for various reasons, such as: They want to save time and money. Getting the proper permits can be tedious and complicated, depending on the city or county where you’re located. And of course, there’s the corresponding filing fee that can cost hundreds of dollars. They thought they’d be staying in their homes forever. When you think you’re never going to sell your home, unpermitted work becomes even more appealing. They want to keep their assessed real estate value low. This way, they can save money on property taxes. Here are some of the potential pitfalls of buying a home with unpermitted work: If the city inspectors in your area discover that your home has unpermitted renovations, you become liable in obtaining a retroactive permit on the already completed projects. The cost associated with retroactive permitting will depend on the scope and value of the construction. And since the cat will also be out of the bag, you may also be responsible for paying back taxes on the increased value of the home. You could also be on the hook for associated interest and penalties. You've fallen in love with a home that has a finished basement, only to discover that it was unpermitted work. In some towns, it is entirely possible for them to ask you to remove the entire project. In others, they might simply require you to tear down and rebuild portions of the remodelled work based on their feedback. When fixing the issue, it might be best to hire a contractor to examine the existing work. They can estimate the cost of bringing it up to code, and also give you an idea of how much is already built in accordance with current codes. Worst-case scenario: the home addition done without a permit included faulty electrical work, which caused a minor fire after you've already purchased the home. Your homeowners insurance company may refuse to cover the damages from that fire when they discover it was caused by unpermitted work. The same goes if something happens in a non-permitted part of your home. If someone falls and gets hurt in an unpermitted deck, or a tree falls on any unpermitted renovation, the insurance company may deny the claim. Trying to collect your insurance policy could also see you going through a complicated lawsuit. Work with a trusted real estate agent. The last thing you want to do as a home buyer is to take the matter of pulling out permits or paying fees into your own hands, especially if you can avoid it. Make sure you work with a local and experienced buyer's agent who can guide you through the home buying process, especially on the impact of unpermitted remodelling works. They can also help you account for it when creating an offer. He or she can also help you put language on the purchase agreement before signing where the seller will be held accountable (which will be discussed further). Get a thorough home inspection. Make sure you don’t forgo the home inspection since it can identify unpermitted construction, work not completed to code, and other potential red flags so you know what to expect before committing to buy the property. The home inspector can also check with the local permitting department to see what permits have been pulled. Ask the seller to fix the problem. The good news is that if you haven’t signed the purchase agreement yet, the seller can be held accountable for obtaining and closing out permits. However, keep in mind that it could take weeks or even months to close out permits, which could delay the closing or even put off the sale. Your best bet is to have an attorney put a clause in the contract stating that the seller, at their cost, will have to take care of obtaining any necessary permits, and even resolve any code violations prior to closing. However, if the seller is not interested in fixing the problem, he or she could give you a discount and sell as-is, meaning they’re selling the property in its current state and will not assume responsibility for any work done without permits.

Read MoreCurb Appeal Tips To Show Your Home In Its Best Light When Selling

When it comes to selling a home, first impressions make a huge difference. And sometimes, you only have one shot to convince a potential buyer to take a look at your home and step inside it. You want your property to have a “wow” factor to entice them to inquire further. This is where your curb appeal comes in. Curb appeal refers to the aesthetic look of the home's exterior when you view it from the street. A home with great curb appeal means it is attractive even at first glance—a well-kept yard, no peeling paint, no missing or damaged roof shingles—and gives an impression that it is being taken care of. Many prospective buyers would refuse to go beyond the walkway when they don’t like what they see outside. Likewise, they’d scroll past your listing photos if they don’t find the exterior of your home attractive, especially in today’s competitive market where how a home looks online can greatly influence a buyer’s interest. This is why your curb appeal needs a refresh before you sell your home. Putting an effort into cleaning and sprucing up your home’s exterior is another way to boost your property’s value and help sell it faster. Here are 12 simple, easy-to-implement, but proven ways to improve your curb appeal and set your potential buyers’ expectations. Reminders Finish any project that you started. Once buyers come to your home and see any of your unfinished curb appeal projects, they might think that you neglected such an important home maintenance task, even if it isn't really your intention. They might even wonder what other repair tasks you’ve left unfinished. Pay attention to how your home looks at night. Because some potential buyers drive by houses in the evening, you have to make sure that your home is just as attractive at night as it is during the day. The right lighting can make your home look incredible in evening listing photos, and adds security and safety as well. Put yourself in the buyer’s shoes. Stand outside your property and look at it as if you were the potential buyer visiting for the first time. Tour around and take note of your first impression of the house and yard. Does it look clean and tidy? What’s the first thing you noticed about the property? What makes it attractive? What could be improved? Together with your realtor, look at your home with a fresh perspective so you can work on the areas that need to be improved to entice more buyers to look at your property and submit an offer. Even the smallest things make a big impact. If you think you can’t make improvements to your home’s exterior because of a tight budget, don’t be discouraged. Buyers pay attention to even the smallest of details. This is why simple tasks such as decluttering your yard, hiding the trash cans and other eyesores, updating your mailbox, or repainting the fence, could make a huge impact on your home’s curb appeal.

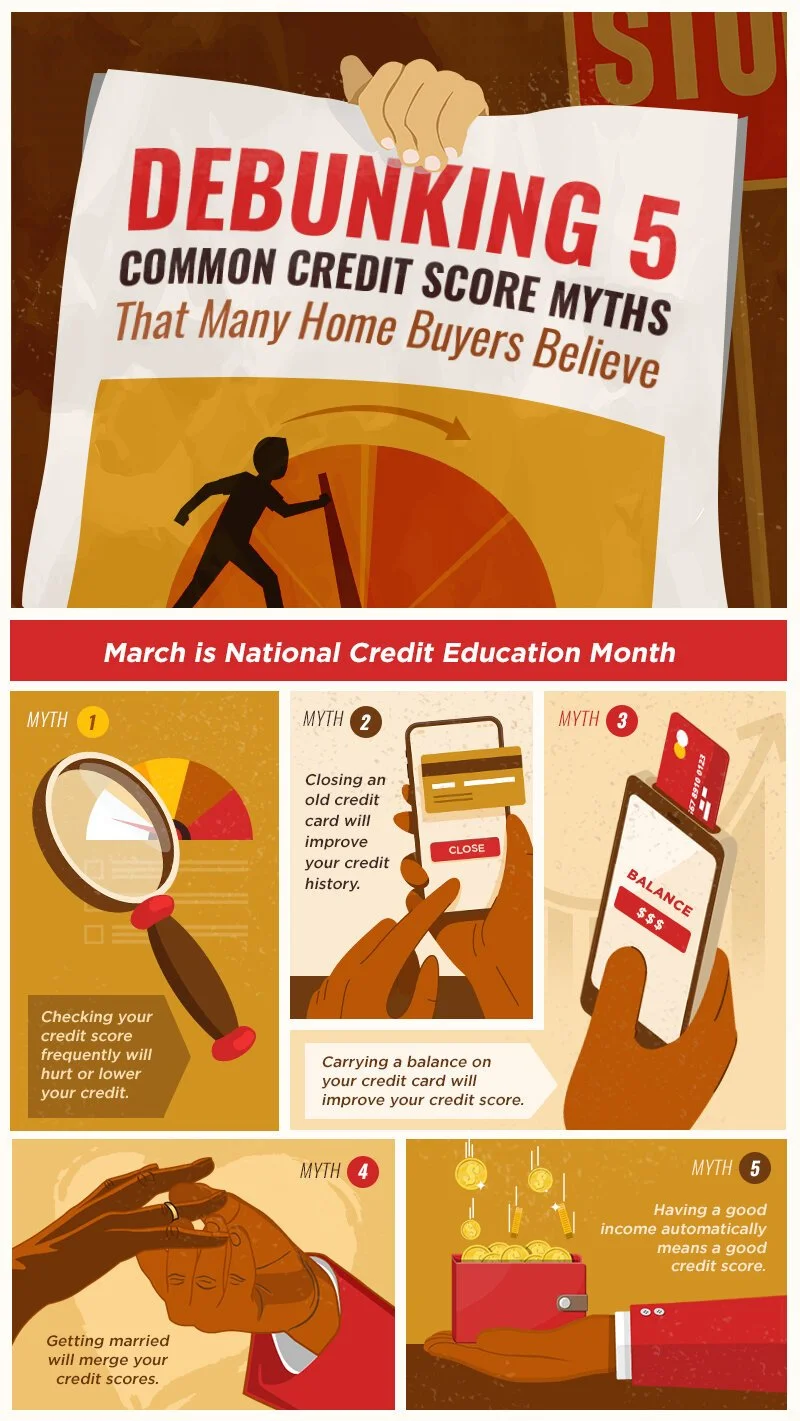

Read MoreDebunking 5 Common Credit Score Myths That Many Home Buyers Believe

When it comes time to buy a home, a good credit score boosts your chances of getting a mortgage because it shows lenders or mortgage companies that you are likely to pay a loan on time. Thus, having a bad credit score can be a massive barrier towards homeownership. This is why understanding and managing your credit score has always been important. March is National Credit Education Month, which means now is the perfect chance to discuss some of the ins and outs of your credit score. And there are quite a few harmful myths or misconceptions surrounding it that many prospective borrowers believe. Here we debunk some of the most common credit score myths and show you the truth once and for all. Because the worst time to find out that your credit score is going nowhere due to any misinformation is when you already set your heart towards buying a piece of the American dream. Myth #1: Checking your credit score frequently will hurt or lower your credit. What's true: Only “hard” inquiries or hard checks can ding your score a few points, but not if you check on your own, which is considered a “soft” check. Hard checks generally occur when you authorize a lender or a company to check your credit, especially if you apply for a mortgage or credit card. This kind of inquiry can have a temporary negative effect on your credit score. On the other hand, soft inquiries don't have any effect on your score at all. This is when you check your credit score and credit report on your own from the three major credit bureaus (Equifax, Experian, TransUnion). It is recommended that you monitor your credit score over time through routine checks to help you track your progress when building credit, and to catch any problems before they get out of hand. You can now easily check your credit score on websites such as creditkarma.com or annualcreditreport.com, or with most card issuers. Also, due to the COVID-19 pandemic, all three credit bureaus are offering free weekly online reports through April 2021. Myth #2: Closing an old credit card will improve your credit history. What's true: Closing a credit card is more likely to hurt your credit score than to improve it, especially if you close the card with a balance. Remember that a percentage of your score comes from the length of your credit history, so if you close a card that you had for some time, your score could be adversely affected. The longer you've responsibly used a particular credit card, the better effect it will have on your credit score. So just leave your accounts open, especially if they’re in good standing and the card has no annual fee. Myth #3: Carrying a balance on your credit card will improve your credit score. What's true: The only thing a running balance on your credit card increases is the interest you owe and certainly not your credit score. In fact, it only has the potential to lower your score and it will end up becoming a waste of money since you need to pay interest over time. This is because any lingering balances on your account directly affect your credit card utilization rate. And the higher your credit card balance, the higher your utilization rate, which can, in turn, hurt your credit score. Myth #4: Getting married will merge your credit scores. What's true: Even after you tie the knot, you and your spouse remain to be two individual entities with separate credit scores and credit histories. So just because you marry someone with a good credit doesn’t mean that your credit score will automatically improve. Likewise, marrying someone with bad credit won’t adversely affect you. However, when you fill out a joint application for a mortgage, each of your credit scores is checked and taken into consideration by lenders. So if one of you doesn't have a good score, it could be an issue. Myth #5: Having a good income automatically means a good credit score. What's true: Your income does not directly affect your credit score. Also, it is never included on credit reports so it can’t impact your score. FICO scores are influenced by five differently weighted factors, including payment history (35%), amount owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Having a great job with a good salary can help you improve your finances. But your credit score is based on how you have managed credit in the past, and if you have a bad history of managing your credit, then a good income won't help you fix that. If you’re applying for a mortgage, lenders will assess your earnings and your credit score as two separate pieces, before approving you for a loan. So no matter how much money you have or how much you’re earning, making on-time payments on any outstanding accounts is the best thing you can do to improve your credit score.

Read More5 Cleaning Habits You Need To Break for Better Housekeeping

Cleaning is tough, but it's something we need to do consistently to take care of our humble abode. Not to mention it’s a crucial task to keep our family and home safe in this pandemic age. But since it’s a tedious job, we’re often guilty of cutting corners to do it “faster” and easier. This could result in developing bad habits that are actually hindering our ability to get the job done more efficiently, and sometimes could even cause harm to our family and our home. It's time to figure out if you’re guilty of these bad cleaning habits, and then drop them out for good, one at a time. This way, cleaning won’t be a tougher job than it was supposed to be, and you’ll be left with a cleaner and healthier home. One thing to remember when cleaning your home is to always dust first and work from the top of the shelves, then down and around. This way, dust that doesn't get trapped in your cloth or duster will land on the floor to be swept or vacuumed away. This seems like a huge irony, but it's something that we’re often guilty about. How can you expect to get clean results when you are using dirty cleaning tools? Using a dirty duster will just push around dust all over the place. By wiping your countertop or stovetop with an already soiled cloth or a dirty sponge, you are just risking cross-contamination between surfaces. If your vacuum bag is full of dust or its filter hasn’t been changed, it just won’t do its job of sucking up dirt any more. Using dirty cleaning tools isn’t only ineffective, but it’s also the culprit in spreading further germs and bacteria. So take the time to thoroughly clean your tools after every use by using hot water and disinfectant so they are ready for your next cleaning job. You can also check if you already need to replace them. For vacuums, washing machines, dishwashers, and other cleaning appliances, read the manual first and follow instructions on how to properly clean them. But “more” is better, right? Using a lot of cleaner will work better and faster, isn't it? Unfortunately, that’s not how it works. Any residue that was not rinsed away completely will just become a dust and dirt magnet. Using too much laundry detergent, for example, will just make you wash the clothes again to remove the excess detergent. Over-applying any cleaning product is simply just a waste of water, time, and money. This is why it’s important to read the label (more on this later) and use only the recommended amount of cleaner for the job. Just like how using too much cleaner is a common mistake, using a harsh cleaner to do the job can also be a bad habit that can do more harm than good. Household staples, such as chlorine bleach, may be a good disinfectant but is too harsh and can cause more damage than just removing dirt and grime. It can be hazardous to your family and pets, and could even strip away your home's surfaces, furnishings and finishes. Take extra care when deciding what cleaner to use and if it is appropriate for the job. Most cleaning tasks require nothing more than gentle and natural cleaners that are also safe and environment-friendly. If you can’t skip the bleach, remember that a little amount goes a long way. It will just take at least 30 seconds to a few minutes, so why skip it? Not reading the label on the cleaning products before using them is a surefire way to make a cleaning fail. You'll save time and effort (and extra minutes of scrubbing) when you follow the directions on the product, especially if it needs to “sit” for a period of time to do its magic. Follow the manufacturer’s recommendations on proper usage, how much you need, what surfaces it works on best, and even storage tips. If it says to only use a capful of detergent for a load of clothes, or just a few drops to a cup of water, follow just that and don’t use double or triple thinking that you will maximize its effectiveness. It's in the manufacturer's best interest to ensure the product works for you, so make sure you heed their advice.

Read MoreHow To Get Over The Heartbreak of Losing Out on Your Dream Home

It's already stolen a piece of your heart. You’ve spent countless hours thinking about it. You know it’s a huge commitment, nothing like you’ve ever had before, but you’re more than ready for it. You had such big dreams and imagined the two of you growing old together. But then you lose out. Maybe your offer got outbid. Or maybe the seller chose a cash buyer. Maybe the deal fell through because of an inspection fiasco. There could be a number of reasons why your dream home got away, but one thing’s for sure: the heartbreak is real. It’s painful, and now you’re no better off than when you started. This situation—”the house that got away syndrome”—isn't uncommon, especially to first-time home buyers who could fall in love with any home easily or swoon over cosmetics alone, such as an updated kitchen or a good curb appeal. So how to cope when your supposed “The One” turned out to be just another listing and another buyer’s new home? Here are three tips to help you get through it. 1. Don't pretend it’s “no big deal.” After all, it is a BIG deal. So don't pretend that it doesn’t hurt. You should allow yourself to go through the grieving process and feel everything because you’re mourning a lost dream. As you start planning on what furniture will go on the patio, or what lovely color to paint the walls with, you got the house of your dreams snatched away by another buyer, which crushed your high hopes. Now, you couldn’t do anything about it except let yourself grieve. It’s okay to feel bummed for a bit. Just remember that the idea of your dream home might have been shattered, but you could pick up the pieces and treat them as lessons to be learned as you move forward. 2. Change your perspective and set new goals. It's truly devastating to lose out on a home you fell in love with, but remember that there are lessons to be picked up after every heartbreak. And they will help you remain hopeful and move through grief of the house you just lost. Try to widen your perspective so you’ll understand what worked and what can be improved, then set new goals with those lessons in mind. Was your dream home too far out of your budget? Did you go too low? Did you move on it too slowly? Is it possible to live with two bedrooms instead of three? Do you really want to live in that hot neighborhood, or perhaps you’re willing to move further away from the city? Would you be willing to take a second look at your list of wants vs must-haves? What can you do differently this time? Assess yourself with these questions when setting your new goals so they’ll be more specific and attainable. Because no matter what went wrong in that previous chapter of your home-buying journey, believe that things happen for a reason and that the house that’s meant for you is just somewhere out there. 3. Prepare to get back in the house-hunting game. You've mourned and you’ve learned. Sooner or later, you will be okay to test the waters again. While it can be difficult to forget about the “house that got away”, remember that there are still plenty of houses out there. You need to completely get it out of your head so you can start looking at other properties again. Get back in the game like you never left. Just don’t forget that you’re better and wiser this time around. You must know exactly what you want in your “The One,” while also being mindful that not every listing is perfect. Maintain your level of diligence as if it’s your first time house-hunting. Understand your budget so you won’t experience another heartbreak on a house that will turn out to be just a money pit. Lastly, try to gradually learn to detach yourself from the emotion. Because at the end of the day, buying a home should be less of an emotional affair and more of a business transaction where you have to avoid making bad decisions. Even if you’re in a competitive real estate market that has low inventory, believe that you can still find the house you want. You just need to be prepared to claim it when it comes. Hopefully, you will be happier with the home you end up with so you can completely forget about the one that got away.

Read MoreTop 5 Situations Where You Should Accept the First Offer on Your Home

It's natural for many sellers to be hesitant to accept the first offer they receive on their home. They may want to entertain multiple offers from interested buyers and could even be thinking about potential bidding wars. In certain circumstances, however, the first offer on your home may actually be the one you should accept. It might make more sense, especially if it is a fair one and you are living in a fast real estate market. Here are specific cases where the first offer on your home is the one worth taking: Whether you need to relocate quickly for financial reasons or if you are experiencing a major life event, such as a divorce or a job transfer, your main goal is to sell the property as quickly as possible. It will be a huge relief for you and your family since you can reduce the amount of time you have to pay to cover your living expenses at two homes. Explain your situation and motivation to your real estate agent so he or she can market the property to secure the best selling price from a serious buyer to avoid the deal falling through. If your home has been sitting on the market for weeks now for whatever reason, the first attractive offer that comes could be your best bet, especially if it isn't a lowball offer. Accepting it might make more sense if you don’t want your property to continue losing its value. You may want to consider if a buyer gives you an all-cash offer. Cash buyers are usually a safe bet since they don't have to wait on their mortgage to be approved and their offer comes with fewer to no contingencies. This offer can give you a much smoother transaction even if it’s not necessarily the best deal. An all-cash offer is also great if you need to move quickly for financial reasons or if you’re experiencing a major life event. Just make sure to carefully assess the buyer with your realtor to ensure a smoother transaction. Houses that are considered weird, quirky, or contemporary won't likely appeal to the general buyers, which means they can be trickier to sell. Just check this “dome home” in Sedona, Arizona, for example. This 2,400-square-foot octagonal property with four bedrooms and two baths prompted many agents to worry on how to make its peculiar features marketable. There’s a good chance that offers will be few for those kinds of houses because of its small group of interested buyers, so the first offer will likely be your best option. If you've inherited a home from a deceased loved one and your main concerns are to get a fair price and have a smooth transaction, the first attractive offer that comes your way may be the one worth accepting. This way, you can sell the house as soon as possible and move forward to the next phase of your life.

Read MoreLetting Go of the Home You Love: Tips To Deal with the Emotional Impact of Selling Your House

Your home may be your biggest financial asset and investment, but once you decide to sell, everyone will agree that it's also more of an emotional journey. After all, you’re not just leaving a home that you loved—you’re ending a “love affair” with a place you’ve had for a long time and have lots of memories tied to it. It’s where you’ve raised your family; held countless Thanksgiving (or friendsgiving) dinners and parties, so it’s completely normal to be sad about moving. If you are not able to deal with the emotional stress of selling your property, it can hinder you and your realtor from achieving your goals and creating your ideal financial result. This is why it's also worthwhile to take into account the emotional attachment you have with your home. Here are some tips to get you through what can be a taxing sales process, especially if you fail to deal with it early. If you're having apprehensions about selling your property, try to reframe your mindset and start thinking that you’re no longer a “homeowner” but a “home seller.” This will help you adopt a more objective attitude towards the process, and gradually accept that your home is now a product that you have to sell and that others will hopefully want to buy. Changing your perspective might take some time, so don’t be afraid to give yourself a few weeks or months to separate your emotions and set your expectations right, especially if you have the luxury of time to do so. It might be helpful to do some research, such as talking to friends who have sold their homes or reading about other people’s home-selling journey, so you’ll have a clearer idea of what you are getting into. Hopefully, doing your due diligence will also help make the transition easier. When preparing to list your home for sale, one of the crucial things to do is to make it less personal. This means removing framed family portraits, mementos, travel souvenirs, diplomas — anything else that is personalized and screams that you own the home. The main goal of this process is to make it easier for potential buyers to envision themselves in the house, especially during showings. However, packing up your photos and mementos earlier rather than later will also help you as a seller to let go. Likewise, try to change the little parts of the home that you've come to love so much, such as your favorite wall color in the bedroom or dining room. Once you’re used to not seeing them, it will make it easier for you to detach yourself and see the home as merchandise waiting to be sold. Hopefully, it will also help you realize that the house isn’t the one that carries precious memories, but you and your family. Take the time to reflect on how the house has served its purpose for however long you lived there, and that you’re letting it go to move on to your next. Don't forget the old adage “home is where the heart is” to help you think of home in terms of the people you love rather than in terms of a place. May it be your spouse, children, parents, or even friends whom you treat as family members, remember that your real home is wherever the people you love are. Take photos of the property, revisit old memories with them, and reminisce about how you all loved living there. The process will hopefully aid in accepting your emotions throughout the home sale. It's natural to be anxious and stressed about moving. It’s even natural to grieve when thinking about the old memories you’ve had at your home. After all, you won’t just be letting go of the house per se, but you’ll also be leaving a community you’ve grown with. But no matter how hard it seems, remember the reason why you’re selling in the first place and what you’ll gain afterwards. List these things out, then look at that list whenever you’re feeling down about relocating. If you’re selling so you can downsize, think about the extra money you’ll be able to save. Same thing if you need money from the home sale to pay off other debts. Whatever reason you have—whether it’s to downsize, upsize, for retirement, or just be closer to an adult child or to other family members—try to focus on that instead of entertaining the feelings of losing your beloved home. It might be difficult to do at first, but once you think positively about these changes, you’ll look forward to moving on to a new home like it’s another adventure that’s bound to happen. When you figure out your “why” and establish your goals for selling, it's crucial to find and choose a partner who will be your guide as you go through one of the most important decisions you’ll make. Hiring a top realtor to help you sell your home is beneficial to your emotional and financial well-being. You will share your goals with them, and then work together to create a game plan to achieve those goals as much as possible. Your agent will be responsible for marketing your home for sale, negotiating your deals, helping you review purchase offers, guarding your interests, and guiding you in making informed decisions by providing adequate knowledge. Your agent will help you navigate the complex home selling process while being compassionate about your feelings. This is why it’s imperative to partner up with an expert realtor who has worked with many sellers in the past who have gone through the same things. Your agent will be the one to maintain an emotional detachment and treat the sale solely as a business transaction. If you trust your realtor and their strategy, you can focus your emotional energy on finding your next home, making the entire process less stressful and hopefully more enjoyable.

Read More5 Things That Could Go Wrong If You Skip Hiring A Real Estate Agent To Buy A Home

If you are thinking about buying a house this year or even in the near future, one of the things you might have been asking yourself is whether you need to hire a real estate agent or not. After all, you know how to browse through online listings (which is something you might already love doing during your free time). It should be easy enough to find a property you like, contact the listing agent, and then go from there to get your dream home. So why bother using a realtor? What's the point? In reality, purchasing a home isn't as simple as buying something online or even buying a car. It’s one of the most significant transactions you’ll ever deal with. Here are just some of the few risks you’ll be leading yourself into when you decide not to hire a buyer’s agent and enter a complicated real estate transaction without representation. House-hunting nowadays may have been made easier by the internet. Buyers are now able to see homes available for sale in various real estate websites. However, real estate agents have access to a wider variety of available listings that aren't listed on traditional channels. Likewise, a buyer’s agent will help you to widen your search terms so you’d see more homes that fit your needs. Also, your expectations will be matched with the reality of what is currently available in the market and what houses you can afford. Having a professional who has their pulse on all the data will make the arduous home search process more bearable. Without a realtor, you're going through this journey with no neighborhood specialist to rely on. Sure, you can and (actually need to) research vital information such as school districts, zoning codes, crime rates, local trends, current market values, etc. But local real estate agents will be able to tell you more about those things, and give you reputable data and other facts about the neighborhood you're considering. They probably even know the best coffee shops or restaurants in town, making them the best resource if you want to familiarize yourself in your potential neighborhood. Besides, doing some research on your own is a tedious task that is best to have help with, especially if you have no idea where to start. When touring houses, many first-time home buyers don't know how to spot potential problems that could cause issues in the sale later on. They may be blinded by the cosmetic finishes and upgrades instead of being on the lookout for these potential issues. But your agent will be able to recognize any telltale signs of issues in a property, such as mold, roofing problems, pests and insect infestation, water leaks, damp or wet basement, cracks in the foundation, and others. With their keen eye and experienced judgement, they will be able to help you determine if there are additional inspections necessary, including radon or mold inspection. Your realtor will also tag along during the home inspection to hear what the inspector finds, and help to accurately convey the information to you as a buyer. Even if you think of yourself as an expert negotiator, you will need a professional who is adept at negotiating the best price for your home purchase. By analyzing the value of the home you're looking to buy through comparable sales or “comps”, an exceptional buyer’s agent will help you come up with a competitive offer. They will also advise you on what should be your next steps once the seller responds. They will help you look at the current conditions of the property to find any issues that could be leveraged during negotiations, especially after consulting the home inspection report. By having a talented negotiator in your corner, you’ll be assured that the price you intend to pay is the price that the home is worth. When you decide to buy a home without getting the help of a real estate agent, you'll be left to review and understand on your own the tons of documents involved in a real estate transaction. The real estate industry is already full of legal jargon—but more so the multiple contracts and paperwork that also have to be 100 percent correct. Sure, any confusing term is just a Google search away, but would you want to take such a huge risk when your biggest investment is at stake? Real estate agents can explain the impact of those terms or clauses to you so you can have a thorough understanding of what you’re getting into. They can clarify the difference between a disclosure and an agreement, go over seller disclosures, or explain every contingency that might affect the deal and put you on the losing side. By having an expert on your side, you’ll be able to ask the right questions, cover every base, and to make sure you’re not being taken advantage of by the other party. Buying a house can be stressful and overwhelming so it's definitely something you wouldn’t want to DIY. From questions surrounding the home buying process, crucial information about the neighborhood you’ve been looking forward to calling your home, to understanding the fine print of your contract—the benefits of hiring a realtor are immeasurable. Now more than ever, you need someone who understands your unique situation and will help you achieve your dreams of homeownership in the best possible way.

Read More6 Doable Resolutions To Help You Save For A Down Payment on A Home

Having enough money to put as a down payment is one of the biggest roadblocks to purchasing a house, especially to first time buyers. If you're one of the many people who aspire to turn their homeownership dream into a reality, you probably know that among the many things you need to start doing is to save money for a down payment. However, it’s easier said than done and may be dependent on many factors, such as your income, current debt, responsibilities, etc. Even your current savings play a huge role in how much you still have to save. So whether you're planning to buy a home this year or even in 2022, here are six savvy ideas—you can even think of them as new year’s resolutions—to help you achieve your savings goals to buy your dream home sooner. If you're having a hard time sticking to your budget, start by seeing where your money goes to each month. Keep track of your daily purchases and payments through a spreadsheet or an expense tracker app, then review them at the end of each month. You may be surprised how much of your budget goes toward non-essential expenses that are making little dents in your account. Since the pandemic started, many of us may have already been conscious about our spending habits. This time around, figure out how you can tighten up your spending by limiting or reducing your expenses. By making these small cuts or sacrifices in your daily routine, you'll be amazed at how much money you can save, which is a huge deal if you really want to make your dream home a reality. Here are some ideas to reduce spending, depending on what applies to you and your lifestyle: Minimize eating out and take out, and save them only for special occasions. Review and limit your monthly subscription services. Is your cable bill costing you hundreds of dollars a month, but you’re more of a Netflix guy? It might be time to totally cut it out. Cut down on designer coffee and other expensive beverages. Also limit your alcoholic beverages whenever you eat out. Reduce your clothing budget, especially if you’ve already been working frequently from home. Speaking of reducing your expenses, there are ways to slash some dollars off your grocery bill and get huge savings. Shop smarter by sticking to your grocery list to avoid any impulse buys. It might also be helpful not to buy on an empty stomach. Choose to shop at grocery stores with cheap prices or at local farmer markets, rather than at an upscale grocer. Lastly, make an effort to switch to cheaper but quality store brand labels. Any unexpected money that isn't part of your monthly income are known as “windfalls” in the financial industry. These windfalls could be an annual bonus at work, inheritance, cash gifts, tax refund, a birthday check you received from your parents or grandparents, and any other instances in which you get extra money. Instead of spending them on a new gadget, appliance, or on a shopping splurge, stash them away as part of your down payment savings. It might not look fun, yes, but remember that you're working towards a more ambitious goal. That extra money is a surefire way to fast-track that goal. Likewise, it will be crucial just in case you encounter an unexpected expense and you can’t afford to deposit your usual savings. So if you’ve been itching to buy that latest big-screen TV using that holiday bonus, tell yourself that it can wait. Besides, chances are it will suit your new home better. Challenge yourself to go on a spending freeze or a spending “diet”. Let's say for two weeks or even a month, you will drastically cut your spending to only your living expenses and necessities—no new clothing, no dining out, no new gadgets, no adding to cart, etc. At the end of the month, review what areas of your budget are you willing to forgo to keep up with your new spending habits that will eventually increase your savings. Creating a separate account for your down payment savings, with no linking debit card or checks, will help you keep your finances in order and track your progress. It will also discourage you from spending your hard-earned money on other things other than its purpose, which is to achieve your dream of becoming a homeowner. Bottom Line Saving for a down payment isn't something that can be done overnight. It’s a huge, collective effort that can be achieved with enough determination and the right circumstances. To help you set a clear goal and determine how much you really need for a down, it’s better to talk with a local and knowledgeable real estate professional who will help you get started.

Read More5 Things You Can Start Doing Now If You Want to Buy Your First Home in 2021

Buying a home is a ‘purchase of a lifetime.' It’s a major financial step that requires a lot of planning and preparation. If 2021 is the year you’ll put an end to your rental days and find your dream home, here are things you can realistically start doing now to finally become a homeowner within next year. 1. Check your credit score and take steps to improve it. Your credit score and credit history play a major role in whether or not you will get a mortgage and could affect the interest rate lenders can offer you. Start monitoring your credit report by getting free copies from national credit reporting agencies. Then, work on improving your credit profile by paying your bills on time and keeping your credit card balances as low as possible. 2. Research first-time home buyer grants or assistance programs. Do your preliminary research and see if you qualify for any first-time home buyer programs being offered by your city or state, where you can get down payment and closing cost assistance, or even special loan programs with lower interest rates. 3. Shop for a lender and get pre-approved. Once you've taken care of your credit but before you officially go house-hunting, shop around with various lenders to compare their offers and find the best deal available. Likewise, getting pre-approved will help you know how much you can borrow so you will only shop for what you can afford. It will also show sellers and agents that you’re a serious buyer. 4. Find a local and knowledgeable real estate agent. Even if you're still months away from entering the housing market, start looking for a real estate professional who will guide you through the complicated home buying process. Your agent will provide you crucial information on homes and neighborhoods, answer any questions you have about the process, and will look out for your best interest so you’ll be satisfied with your biggest investment. Start getting recommendations from family and friends, read online reviews, and interview several agents before making the final decision. 5. Set up a new budget and live on it to anticipate the costs of owning a home. Create a new budget and practice living on it. Make sure you add in the costs of owning a home, because aside from your monthly mortgage payments, there's utility bills, repair and maintenance costs, property taxes, homeowners insurance, etc. With these in mind, you will have a good idea of how much you can comfortably afford and you’ll avoid straining your budget once you’ve become a homeowner.

Read MoreThe Ins and Outs of Giving or Receiving Down Payment Gifts

For many first time buyers, saving for a down payment is one of the most challenging steps in fulfilling their dream of purchasing a home. Oftentimes, they know they can afford their potential monthly mortgages (which could be less or equal their current rents), but the upfront costs of buying, such as down payment and closing costs, may be too much for them to pay. This is why it's possible to get a little help in the form of a down payment gift from a family member or relative, close friend, or even a charitable organization. And it’s actually becoming more popular, especially among millennials. In the National Association of REALTORS® 2020 Generational Trends Report, 13 percent of home buyers (and 27 percent for ages 22 to 29) indicated their source of down payment to be a gift from their relative or friend. So if you’re lucky enough to find down payment fund as one of your gifts under the Christmas tree this year (or maybe you’re the one who wants to give it), it may not be as simple as opening your cash gift (or handing someone a wad of cash) and going straight to the lender to use it to buy a home. Down payment gift funds, whether you’re giving or receiving it, are closely regulated by lenders and must meet certain requirements. Here are certain rules that the gift giver and recipient should know to avoid trouble down the road. While we may automatically consider a family member, like parents or siblings, when thinking about who can give a mortgage down payment gift, there are other entities who could also be eligible gift sources. But because cash can come with strings attached, and lenders want to make sure that the gift money is nothing but a gift (which will be discussed later on), there are restrictions on who can give money (or who you can give money to) to help purchase a home. For conventional loans If you are getting a loan through Fannie Mae or Freddie Mac, gifts can only be from a family member or relative. This may be your spouse, child, siblings, parents, grandparents, or anyone related by blood, marriage, adoption, or legal guardianship. Soon-to-be family members such as your domestic partner, fiancé, or even future in-laws are also eligible to give funds for a down payment. For FHA loans The Federal Housing Administration (FHA) has its own set of rules when it comes to giving or receiving down payment gifts, although they offer a broader eligibility range. If you are getting an FHA loan, you can receive down payment funds from family members, friends who have a clearly defined and documented interest in your life, employers, labor unions, government agencies, and even charitable organizations. For USDA and VA home loans VA loans (backed by the U.S. Department of Veterans Affairs) and USDA mortgages (given by the U.S. Department of Agriculture)may have fewer restrictions, but the down payment gift funds cannot come from anyone who would benefit from the proceeds of the purchase, such as the seller, developer, builder, your real estate agent, and some other entity. There are no limits on the amount of money someone can give you for a down payment or to cover closing costs. However, rules still apply depending on the type of loan and property you're purchasing. Some types of loans may need you to contribute a certain amount of the down. The key is to check with your lender for the latest regulations on how much you can really use. Likewise, there can be tax implications on the person giving the gift funds. They may be liable if the amount exceeds the gift tax exclusion limit. As of 2020, for instance, any individual can give funds up to $15,000 without a tax penalty. On the other hand, parents who are married and are filing jointly can give up to $30,000 per child for a mortgage down payment (or any other purpose), without incurring the gift tax. For a down payment gift that exceeds the said amounts, the donor must file a gift tax return to disclose the gift. You need to confirm the relationship between you and the giver and provide the right paperwork. If you're fortunate enough to have a family member or any eligible entity who can give you funds towards your home’s down payment, you’ll need to confirm your relationship with the gift-giver and provide your mortgage underwriter more information about where the funds came from. For lenders to confirm that the new money isn’t a loan, you’ll need these things: 1. A down payment gift letter - If your lender has a template letter for this purpose, you will need to send it to the funds’ donor. If there isn’t a template, you might want to ask what information should be included so you can draft your own. The letter typically includes details about the gift-giver, such as the name, address, contact phone, relationship to the borrower, and address of the property to be purchased. The date when the gift was transferred and the amount of funds given to the borrower must also be indicated. The donor should also write a sentence explaining that the fund is a gift and that there isn’t any expectation of repayment. The letter must be signed by both the gift-giver and the borrower. 2. The gift-giver’s bank statements - This is to show they have the funds to give the buyer as much money as promised. 3. A bank slip from the buyer’s account - This is to indicate when the money was transferred, to verify that the cash is from a legitimate source and that the borrower has an appropriate relationship with the donor, and to confirm the information provided in the letter. Remember: you can't pay back the gift. Down payment gift funds need to be just like that—a gift and not a loan that is expected to be paid. You need to make it clear with your mortgage lender that the money you received was entirely gifted and not something that you need to pay back eventually, because by then it will be considered mortgage or loan fraud. Besides, it can also put your loan qualification at risk since your debt-to-income ratio will be factored when you get a mortgage. Try to make it a “seasoned” gift money. It might make more sense to try and make your gift money “seasoned”, especially if you know that someone is going to help you buy a home (often in the case of parents or other relatives). Lenders refer to it as seasoned money when it has been sitting in your bank account for some time, at least for two months. When the gifted money is given in advance, you often don't have to worry about writing gift letter documentation. Bottom Line Down payment gift funds make it easier for first-time home buyers to afford a home. If you anticipate accepting help, remember to consider the rules above so you can accept such a gift in a proper manner. Be upfront with your mortgage lender if you plan on using gift funds for the down payment. Don't forget to also talk to the individual or entities who are planning to give you money about the tax implications and other considerations.

Read More3 Wonderful Reasons Why The Holidays Are A Good Time To Sell Your House

Should you sell your home during the holidays? It may not be the ideal time, but with the delay in the spring market due to COVID-19 that caused pent-up buyer demand, many people's search for their dream home continues even during this busy time of the year. Here are three huge reasons not to wait until the next year and consider listing your home during the holiday season: 1. Those who are house-hunting are committed and serious to buy. Despite this busy time of the year, buyers who have been actively looking for their dream home are serious and ready to buy. They also want to take advantage of the historically low mortgage rates so they continue to be on the lookout. Holiday buyers are also more motivated to move on the right home especially if they've been purposefully searching since fall or they need to relocate as soon as possible, making them easier to negotiate with and more eager to close the sale. 2. There's less competition for you as a seller. The holidays might look like an unexpected time to list your home, but in reality it’s actually more favorable. There are fewer homes on the market to satisfy buyer demand, giving your house a chance to emerge as a good (if not the best) option for motivated buyers. The minimal competition and huge demand can lead to multiple offers that would help you make a sweet sale. After the holidays, there’ll be more homes that will be available in the market. Builders’ confidence is also ramping up in many states, which means more new construction will be available for sale. If you’re still contemplating on whether to list your home, with these stats in mind you might want to make the holidays an opportune time to finally sell. 3. Homes decorated for the holidays are more appealing. You're already cleaning, organizing, and decorating your home for the holidays, which means there’s no better time to show if off than now. A holiday-decorated home gives off a homey, comfy vibes that stirs warm memories, no matter what we’ve been through this year. Buyers will be more likely to imagine themselves celebrating festive times and making memories with their loved ones in their potential new home. If you live in a snowy state and worried that it might be more difficult to entice potential buyers, remember that just keeping the sidewalk and driveway clear of snow and ice can already make a huge first impression. During a showing (whether it’s virtual or in-person), you and your agent can set the mood with festive holiday lights and decorations that will make your home more attractive. Plus, with many people adorning their homes, your neighborhood will be more appealing, giving buyers a chance to see it in a different light. Bottom Line Despite the prospect of shorter days and colder weather (in many parts of the country), selling your home during the holidays presents numerous opportunities. Moreover, there's a huge potential for a greater and faster real estate deal because of the serious buyers and fewer seller competition. If you’re already determined to sell this holiday season so you can celebrate at your new house, connect with a local real estate agent who will help you turn any potential challenge into an opportunity and make the most out of your biggest investment.

Read MoreThe Rise of Multigenerational Living and the Challenges That Come With It