MOST RECENT BLOGS

12 Telltale Signs It's Already Time For You to Move

According to the U.S. Census Bureau in 2016, more than 42 percent of people said they moved for a housing-related reason. Many of them either wanted a new home or a better apartment. Other reasons people cited for moving include family and employment-related reasons. “The decision to move can be personal and contextual. What causes one person to move might not be enough to convince another,” says David Ihrke, a survey statistician in the Journey-to-Work and Migration Statistics Branch. So whether you're looking for a new job in another city or just plain sick of your neighbors, there can be plenty of good and practical reasons why it could be time for you to move. Here are 12 common signs to help you decide whether it’s already time for a fresh start: 1. You need a bigger space. This is a common dilemma for many first-time homeowners who live in starter homes. You don't remember your house to be this small in the first place, and it served you well. But now you realize you just don’t have that much storage space, things are getting a bit tight in your household, and you’re now often waiting in line for the bathroom (especially in busy weekday mornings!). If you find yourself in one or more of these situations, then it’s an obvious sign your house has become too small for your needs and that it’s time for you to move. Especially if nothing has changed even after you cleared out your clutter and reorganized your home. A remodel can also be an option, but if you find it’s not even possible in your current home and it can even be costly, then it’s high time you move to a bigger place. 2. Your family is expanding. If you’re planning to have more kids and/or pets, it might make more sense to move to a larger home to accommodate your growing family. Because it will always come to the point when your sweet and nice two-bedroom bungalow won’t be able to carry the load anymore. You’ll definitely be needing more space—whether it’s a big backyard, individual rooms for your children, extra rooms for work and play areas, extra bathrooms, and even a bigger kitchen. Because of these reasons, selling your current home to move to a bigger one is often a logical solution. Also, there can be various aspects you want to add as you begin a new house search, like moving in a great school district and near pet-friendly parks. 3. There’s just too much empty space. Another scenario: your grown-up children have moved out, leaving you and your spouse in your empty nest. There are too many unoccupied rooms that you don’t need. Yet, you’re having trouble keeping up with the maintenance and demands of your spacious home. For empty nesters, it can be a fairly difficult decision to move out. After all, every part of your humble abode holds too many fond memories. However, downsizing is also a great reason to sell. Decluttering and moving to a smaller home can also be rewarding in many ways. There will be lower maintenance costs, lower utility bills, and less time cleaning the house, which means you’ll have more time to do what you love and engage in new hobbies. 4. There’s a change in your relationship. A change in your relationship status might also mean a time for a change of place. If things are going well with your significant other and you decide to move in together, your humble condo or apartment may already be too small for two. You and your partner will definitely need a bigger space for your clothes and other belongings. If your closet space is barely enough for your own clothes, then there’s no way it can accommodate your partner’s as well. Otherwise, if the relationship is getting shaky and you’re both starting to be indifferent (we’re sorry to hear that), then it may be time to reconsider and move out for good. 5. Other family commitments In life, there can be various family commitments that will require you to make a move—maybe you need to take care of a sick or aging parent, your partner needs a job transfer, or you really need to move near your in-laws so they can help take care of the kids while you work. Since it’s family-related, just try to look at the brighter side of things and see what you can look forward to in your potential relocation. 6. Your financial situation changed. Whether it’s turning for the good or for the worse, a change in your financial situation will also prompt you to decide if it’s already time to move. If you’re always stressing out about utility bills and a hefty mortgage and it’s taking a toll on you and your bank account, then moving to a smaller and more affordable home may put you in a less stressful financial situation. It may also be an only option if you were unlucky to have lost a job or lose a significant amount of money. Likewise, it’s very fortunate if your financial standing has improved—especially if your career is steadily improving, you received a raise, or you landed a higher-paying job. It’s also a time to think whether you want an upgrade and live in a nicer home in a better neighborhood (perhaps it’s something you’ve always dreamed of and worked hard to achieve). While you still have the options to renovate your current home, if those renovations will actually cost you more and will give you problems along the way, moving in a new home is a better idea. You may also find that there are features that you can’t easily add in your current home however you want to, like a bigger backyard, central air conditioning and heating, or a modern kitchen. 7. It would cost you less to move to a new house rather than to keep repairing your current home. And speaking of renovations, it might be helpful to take a step back and examine your finances if the work you’re putting in is already too much. Despite the fact that you have already put too many repairs and DIY work in your beloved home, it’s now time to think how it affects your wallet and your overall stress level. See if the repair costs of your current home are eating up your hard-earned cash and whether it will be more practical to move to a new home that needs less upkeep. It’s especially crucial if you live in a fairly old home and your repair costs are slowly getting out of control. Seriously consider whether the costs already outweigh the emotional attachment you have with it. 8. Your neighborhood is in decline or you just don’t like it anymore. If your neighborhood’s quality is starting to decline and it has lost its former reputation and charm, it can be a very compelling reason for you to move. Anyone who’s experienced the home buying process would have encountered the real estate mantra: location, location, location. Well, the importance of location should not be underestimated even when you’re already a homeowner. It’s now time for you to consider if your once good and welcoming neighborhood is now showing signs of going for the worse—increasing crime rates or a recent spike in police activity, dogs barking loudly at night, unruly neighbors, increased pollution and other environmental hazards. If your neighborhood is already becoming too dangerous and/or unbearable to live in, it might be a good idea to relocate as quickly as possible before it gets harder to rent or sell your place. There’s nothing more important than living in a safe and secure neighborhood. You need to also consider the fact that the value of homes in bad neighborhoods can also decline, including your home. 9. You desire a different climate. If you never seemed to stop complaining about the weather all year round, it’s also a good reason for you to seriously consider relocating. Are you getting tired of weathering the endless cold and snow (and shoveling snow on your driveway) all these years? You’re probably already dreaming of living in a city with a sunny and warm climate. Or maybe you’re already frustrated with the never-ending heat. The thought of living in a new city with a more pleasant climate is a desirable factor for many people to move. 10. Your commute is slowly killing you. If you live far away from work and your commute time is already killing you, isn’t it time for you to consider selling and move? Just think: commuting to and from the office takes so much of your money, gas, and precious hours every day. Your time could have been better spent with your family and loved ones, or in doing more important things. Studies have already established the benefits of a shorter commute to a person’s health and well-being. Moving closer to work will also give you more time for sleep and relaxation. If your current job is looking secure in the long-term run, there’s no other reason why you can’t start a new house search and pack up. 11. There’s a job opportunity in another city. Likewise, getting a new job or the need for a job transfer is also a common reason why people move. Maybe you’ve been given a promotion or an opportunity to further develop your career, or you’re moving into another city where there are more opportunities available for your specific industry. Whatever it is, employment-related reasons remain as one of the most popular and perhaps one of the most exciting reasons why people relocate. 12. You want to experience suburban living. Are you one of the many city dwellers who are already tired of living in the so-called concrete jungle? Then perhaps living in a more peaceful suburb is captivating enough for you to want to move. Many couples and young families choose to move into the ‘burbs every year because of many factors, including safer neighborhoods and tight-knit communities, lower cost of living, and great school districts. Not to mention that houses there tend to have bigger square footage and more outdoor space compared to houses of the same price located in the city.

Read More7 Secrets To Getting A Mortgage Without A Full-Time Job

Let's face it: there’s already a growing number of freelancers, contract workers, and gig economy workers in the U.S. It’s not surprising, given that many people now want to be their own boss or work from their own homes while sitting comfortably in their sofa. In a 2017 survey conducted by Upwork and Freelancers Union, 36 percent or 57.3 million Americans are already working as freelancers. According to a 2017 study by ReportLinker entitled Happy in the Home Office, Freelancers Embrace the Gig Economy, 77 percent of the US working population works in full-time or permanent roles, but at least 26 percent of these employees are likely to become a freelancer or an independent contractor. Although many freelancers or contract workers have the freedom to work whenever and wherever they want, that freedom pays its price when it’s time for them to buy a home. In the mortgage world, lenders can be leery of extending money to people who actually lack full-time employment because they are a bigger risk. Lenders tend to look for those who have a steady flow of income, including a two-year history of employment and the likelihood of that continuing in the next couple of years. And yet, all hope is not lost even if you’re a freelance worker who aspires to buy a home. Here we share with you some of the best-kept secrets to help you prepare for the home loan application process even if you don’t have a full-time job: Proper documentation makes a big difference The number one advice for freelancers and gig economy workers who want to buy a home: organize all of your necessary documentation that will show a solid work history. Prepare all your records, including proof of employment and income, records of your previous work and employers, names and phone numbers of your credible references, credit union statements, tax returns, debt records, proof of assets, and other important documentation. Unlike with typical borrowers, gathering these documents is crucial since you have to work harder to convince a mortgage lender that you can get a home loan. Lenders need to know that you have a reliable income history to assure them that you can actually make your payments. If needed, submit a letter from your client confirming your contractual work, as well as canceled rent checks and paid utility bills. Spend time organizing, compiling and proofreading all of these important documents and then present them as truthfully as possible. It is also advisable to write a brief letter summarizing your case—stating your stability, strengths, and willingness to fulfill your mortgage application. Educate your mortgage lender about what you do for a living Take the time to educate your mortgage lender about what you do for a living to help establish your case. They need to better understand your job, so explain to them what you do in details. Perhaps you could provide any information about your industry, including news articles or social media reviews. You could also provide a letter from your client(s) detailing your contractual work to help you affirm your case. Likewise, having a work history within the same industry or utilizing the same skill sets can also help. Don't forget to talk to your possible mortgage professional about your home buying goals. It’s a good way to maintain a favorable connection with your lender to assure him/her that you’re a borrower who is easy to transact with. Get pre-approved Whether you're a full-time employee or a freelance worker, getting a mortgage pre-approval remains the first step in your journey towards homeownership. However, it’s more vital for freelancers because they may struggle to fully understand their financial standing in the eyes of lenders. Getting pre-approved will help you know if buying a house is even possible, and how you can better prepare for it. The process will let you know how much money lenders and bank institutions are willing to lend you. If you don’t want to get your mortgage pre-approval from a commercial bank in fear of early rejection, try to get pre-approved with your credit union. Credit unions are more likely to lend to buyers who don’t fit the typical mold or those who don’t have a traditional profile, says Curt Long, director of research and chief economist for the National Association of Federal Credit Unions in Arlington, Virginia. These financial institutions also appeal to borrowers with less-than-stellar credit or those who don’t have an excellent credit history. They also offer special grants and programs that appeal to first-time home buyers. Once you know how much you can actually afford, you can use that as a guide on searching for listings that are within your price range in your desired location. Pay off your debt and maintain a good credit score Because of your status as a gig economy worker, mortgage lenders will definitely need to have more assurance that you are financially responsible; that you are qualified for a loan, and that you are a good risk. Carrying a huge amount of debt or having a credit score lower than 620 won't do you any good when it’s already time for you to apply for a loan. Take the necessary steps to get your debt-to-income ratio to zero or as low as possible. Check your credit report and do what you can to improve your credit score and keep it in excellent standing. Prove to lenders that you are a responsible borrower who will be able to repay his/her loan. Show an impressive amount of savings Aside from proving that you are financially responsible for establishing a steady source of income and a solid credit history, you also need to impress lenders by showing that you have a respectable amount of savings. They would love to see that you are able to save money large enough for a down payment. It will also help reduce the size of your loan. While it may mean living a frugal lifestyle, or reducing your usual weekly Saturday night outings to only once a month, just think that every dollar you save will help you get closer to your own house keys. If you want to get started with saving, here are simple tips to help you do it. Hunt only for listings that are within your price range Use your mortgage pre-approval as a guide to only search through listings that are within your price range. Yes, it may come as a little disappointing that you can't get your dream house (but costs twice of what you can afford!). But remember what’s more important: you’re a bigger risk in the eyes of lenders, and you don’t want to be house-poor either. You need to show your potential lender that you’re only looking at properties that are safely within your established budget. If you’ve been paying rent month after month, it’s a good starting point to let your lender know that you can really afford a mortgage. Calculate your proposed mortgage, plus an additional amount for home maintenance and other costs, and compare it to your current rent. If you’ve been paying more in rent—and have been consistently doing so over time—it might help you strengthen your application. Present proof of your recent rent stubs and a letter from your landlord confirming that you’ve been paying your rent on time. It will help you get a step closer to your dream home even without a full-time job. If possible, don't get your mortgage from a commercial bank Once you find your dream home within your budget, you can start the purchase process, and weigh your options on where you will finally be getting your loan. Instead of getting it from a commercial or national bank, choose to finance your loan through a small, local bank or with your credit union (as mentioned earlier). If your credit union has a physical office where you can do your banking transactions and not just online, then it may be a good choice. Credit unions are known for their lower fees and rates because they pass on their savings to their members. However, if your credit union is lacking a brick-and-mortar office, it could cause you some issues at closing. The best thing you can do once you’re all set up is to avoid that. If you encounter that problem, financing your loan through a small, local bank is another option. Small banks, like credit unions, might be more willing to work with a borrower who doesn’t fit the traditional profile. They cater more to freelancers and contract workers like you to help you get a mortgage. The Ultimate Advice: Keep on trying :) Buying a house without a full-time, permanent job may not be easy. It is very challenging, yes, but it’s definitely possible. It’s doable only with the right amount of planning, preparation, and coordination with the right individuals who can truly help you. As long as you can provide decent and accurate documentation, together with an excellent credit standing and history, there is no reason why you couldn’t secure a loan to fulfill your homeownership dreams. If at first you failed to secure the home loan for which you applied for, don’t lose hope. In this age and time, you can even find a lending company that specializes in helping borrowers who don’t fit the normal profile. Do your extensive research and soon, even if it may take a few years, you can also move into a place you can call your own “home sweet home."

Read MoreHow To Successfully Buy A Home In A Seller's Market

Planning to buy a home while the market is tight? Don't dive in unprepared! Understand what makes up a seller’s market, and follow a plan to make your offer stand out. A lot of home buyers tend to make rookie mistakes that get their offers rejected in a seller's market. If you want to be successful in landing your dream home when the competition is tight, make sure you understand what a seller’s market is, as well as the factors that influence a seller’s decision. This way, you’ll know what it takes to make the seller choose you. I. Understanding the seller's market A seller’s market happens when there is a tight supply of houses for sale -- creating heavy competition among buyers. In the past year, numerous markets have seen a lack of inventory, as well as a rush of offers when a property gets listed for sale. According to the National Association of Realtors (NAR), the median sale price in April 2017 for previously owned homes was $244,800 -- a 6 percent jump from the median sale price the year before. What causes a seller's market? If you’re a home buyer, you may be wondering why you are currently caught in a seller’s market. Here are a number of reasons that have added up over the years to create a shortage of supply, according to The New York Times and UpNest: Property trends have shown that an improved economy in most areas across the U.S. has triggered a high demand for housing -- all while the housing supply has continued to lag behind. More people entering the market can also be attributed to population growth and relocation caused by increased employment opportunities. Today’s homeowners are now occupying or holding onto their homes much longer than they once did. A lot of homeowners still do not have enough equity in their home for them to gain any profit from a sale. Property owners are simply not in a rush to sell, especially investors who are earning rental income from the properties they bought during the recession. There are fewer and fewer foreclosures in many areas, slashing off another source of homes for sale. A recent drop in interest rates across certain areas the U.S. has allowed more people to qualify for a mortgage. This means that a lot of people are out buying homes because of the confidence afforded to them by a pre-approval. Some areas have been lucky to experience a boost in government housing assistance programs which encourage first-time home buyers to take advantage of low-interest loans, down payment assistance, and tax credits. But then again, there aren’t enough houses on the market to match the influx of buyers. Given the above mentioned factors, home buyers can expect fierce competition for lower and mid-priced homes. But don’t worry, it’s not impossible to land the house of your dreams in this market. You’ll just have prepare yourself mentally, emotionally, and financially. Read on! II. Preparing yourself for the challenge Again: buying a home in a seller's market is a highly competitive endeavour. However, you can still reign victorious with the right mindset and preparation. Find an experienced realtor. In order to navigate a seller's market as efficiently as possible, you’ll need a knowledgeable real estate professional communicating on your behalf. While it’s advisable to do your own research and be involved as much as you can, it is always best to let your agent deal with the listing agent on the other end. Know exactly what you want and need. In a seller’s market, you can’t afford to waste your precious time looking at homes you won’t even be able to consider. If you spend days looking at the wrong houses, the right one may already be sold by the time you get to it. To avoid this mistake, make a detailed list of what you’re looking for in a home (Two bedrooms? Three storeys? A garden?), and ask your agent to only schedule viewings to homes that fit your specifications. Have your finances in order. If the seller of the house you want is neck-deep in offers, he or she is most likely to favor a buyer who promises the most convenient way of settling things financially. To learn more about how to make your offer stand out, read on. III. Making your offer stand out You're most likely going up against multiple buyers, and your chances of getting the home you want will depend on how strong your offer is. Consider the following when making an offer on a home: If you have the resources for it, offer to pay in cash. Cash is always king—no matter what market you're in. In a seller’s market, however, a full-cash offer can be your most powerful edge over the competition. Your all-cash offer will stand out and blow all offers with mortgage requirements out of the water, since you have the power to spare the seller from issues involving escrow, appraisals, and mortgages. Offer your best price. If an all-cash offer simply isn’t feasible for you, you can still win the bidding war by coming in with a strong opening offer. In calmer markets, a home buyer will negotiate the lowest possible price that will satisfy the seller. But when you’re in a seller’s market, you’re really in no position to be stingy -- and offering below the listing price may be the wrong strategy. The seller won’t bother negotiating with you if he/she has multiple bids on the table. Come up with your best price, consult with your agent, and be as generous as you can practically afford. You may even want to consider offering a substantial amount as an earnest money deposit, so that the seller knows how serious you are about buying the property. Get pre-approved for a mortgage. As mentioned earlier, having your financing in order is a very attractive buyer characteristic. Even if you can’t pay in full cash, you can still offer the next best thing: a pre-approval letter from your lender/bank. This letter will confirm your ability to borrow the money necessary to finance the home. Other buyers may offer to pay more, but without a pre-approval letter, their offer still won’t stand a chance against one that is pre-approved. Know how much “moving-out time” the seller needs, and be flexible enough to adjust. There are times when choosing the right buyer doesn’t come down to just the money. Sometimes, sellers favor buyers who are willing to delay possession of the home until they can move out comfortably. If it won’t cause you any trouble to wait a few days (or in some cases, weeks) for the seller to clear out the recently-bought home, be kind enough to do so. Some buyers won’t think it would make a difference, but lessening the hassle on the seller’s part is always a huge plus. Don’t ask for too much, or if possible, anything at all. It is typical for buyers to ask what else they can expect to get with the home that they’re buying. Refrigerators, washer units, free repainting of the front door -- all these are acceptable requests in a buyer’s market, but may be a turn-off in a seller’s market. With tight competition, always assume that you’ll be getting the house and nothing else. Personalize your offer. All sellers want to make sure that their houses will be left in good hands. If you can give them this kind of assurance, your offer will be given more serious consideration. Make the effort to reach out to them via a personal letter. Tell them why you see yourself living in the house, and communicate your eagerness to take care of their soon-to-be former home. This tactic may sound a bit too sentimental to some buyers, but remember: selling a home can be a very emotional process for the seller. If he or she is choosing between closely similar offers, a sincere and personal letter can be the much-needed tie-breaker.

Read MoreHow To Determine The Best Time To List Your Home For Sale

Much like any business venture, listing your home for sale is all about finding the best possible timing. The best case scenario would be one in which the sale happens while the market is at its best, at the same time you are prepared to leave, and to buyers that are motivated to pay more. However, the right time to sell is not the same for everyone --it will all depend on why you are selling your home in the first place. Some may have to sacrifice a bit due to time constraints, but finding the perfect time to sell is possible within a certain time frame. Here are important guidelines to consider when thinking of the right time to sell your house: If you can, take advantage of the Spring fever. According to Zillow research, homes sell fastest and for more money from May 1 to May 15. They call it “the magic window” to sell your home, since buyers who started house hunting in early Spring will want to get settled into a new home before the school year begins, and are most likely to bid higher. During this window, homes can sell up to 18.5 days faster with a premium of $1,700 on average for a median home. If you're not in a rush to sell, you can start prepping your home for sale after the Christmas holidays, and make renovations early in the year so that your house can be in perfect form for viewing during this “magic window.” Be aware of conditions in your local housing market. A buyer’s market happens when the demand is low and housing supply is abundant, causing some sellers to settle below listing price just to get their houses off the market after its been there for quite a while. Naturally, you’d be better off selling your house in a seller’s market, where supply is low and demand is high. This puts you in the lucky position of possibly getting multiple offers, which causes a bidding war and drives up the value of your home. Imagine yourself in the shoes of the buyer. Low mortgage rates inspire first-time home buyers to take the leap and buy their first homes. They’re even more likely to pay more, since low monthly payments give buyers the confidence to go for the house they want. This can be a bit harder to track, but it would also benefit you to know about any local and state news on tax incentives and tax laws, as most potential buyers are encouraged to finally buy a home when tax incentives on purchases are looking good. It may also be beneficial to consider the reasons why you decided to buy this house in the first place, since you can also leverage this when the time comes. Factor in your own timing. While it’s tempting to wait until when it makes the most sense financially, not everyone will have the luxury of waiting until May to sell if they have to move across the country six months before that. Even if you choose to wait it out and rent until the house gets sold, any financial benefit you may get from it will only offset the expense of having to pay for two properties during the waiting period. For some people, however, it’s not always about getting the highest price possible for the home they’re selling (although if it can be worked out, why not?). If you’re looking to buy a house where the market is slow, it could make sense to sell your previous house right now and buy a new one right away so that you can take advantage of the benefits of buying in a buyer’s market. Or, if you’ve found the perfect house and need to make a bid on it soon, selling your current home as soon as possible can be your best move. Again, it all comes down to your reasons for selling. Determine what you prioritize the most and time your sale accordingly. Keep in close contact with your real estate agent and communicate your goals openly. This way, you can both agree on YOUR best time to list your home for sale. Best of luck, home sellers!

Read More10 Smart Tips For Buying A New Construction Home

In an analysis conducted by the National Association of Home Builders (NAHB), it was found that there was a larger percentage of new homes, especially single-family homes, that cater to the preferences of many home buyers today. Significantly, new construction is addressing the substantial demand for homes with special features — two bathrooms, an open kitchen-dining area, and an open floor plan. Some of the cities with the largest new construction markets include Dallas, Houston, and New York, according to 2017 data analyzed by Trulia. For buyers who have already looked at existing homes for some time but still couldn't find the home they want, a new construction home is a good option. There are three ways that you can purchase a new home: you can buy a new home that was already built; choose a semi-custom home built from a set of finishes and upgrades, or have a custom home designed entirely to your preference. However, just as how the home buying process in existing homes goes, there are certain things buyers must do if they want a new construction home. Here are some tips to help you throughout the process: 1. Weigh out the pros and cons The best way to figure out if a new construction home is the best route for you is to analyze first its pros and cons and whether it is going to suit your lifestyle. Do your research and ask yourself a few questions. Some of the pros and cons of new construction homes are: Pros There's no need for long hours of lifting the hammer or using a paint brush to do any customization or repairs. If you’re that type who doesn’t want to do any immediate repair work once you moved in, then it’s a good choice for you. New homes often come with modern design elements and lifestyle upgrades, such as open floor plans, open kitchen, etc. They are also often built-in with the latest smart home technologies and are constructed using more energy-efficient materials that could help lower your energy bills. You can have the builder customize the home based on your personal color palette before construction is even completed. Cons New homes can cost more than similar existing homes. Hard to break it to you, but those fabulous amenities and upgrades can also add up to the costs. The home probably won’t be located in a tight-knit, well-established community of neighbors. New homes, unless it’s purely customized, often have less architectural detail, charm, and character compared to older homes. New homes are not for those who feel great pride and value in doing the upgrades and repairs themselves. 2. Find your own agent who has experience in new construction Find a top local real estate agent who can best represent you and your interests during your home search and the home building process. Be sure that it's someone who has experience in new construction and regularly deals with builders, but isn’t affiliated with the builder. Find a trusted agent even before visiting a builder’s home construction site. Many model homes are represented by a real estate agent who has a relationship with the builder, and many builders won’t allow you to hire your own agent once you already visited their sales office without representation. Seeking the help of a knowledgeable professional who regularly deals with builders and knows the local communities by heart will save you time and money. Besides, it will cost you nothing as a buyer to be represented by an agent since it is typically the seller who pays for the commission. Many builders are also happy to work with agents, so it can be a win-win situation. 3. Do your research on the builder and its reputation Conduct research on the builders of each development that you're interested in. Search for online reviews, testimonials, and any news and updates you can find. Then check for the validity and trends in those reviews, since many builders will surely have a history of both happy and unhappy clients. If possible, also talk to local homeowners or current residents. Connect with them in online groups or communities through social media to better educate yourself before making a decision. Also research on the location and the community where the new construction is being built where you can learn about your potential neighbors as well. Ask your real estate agent if they’ve worked with the builder before and gain insights about their reputation. Bonus Tip: When talking to the locals or current residents, don’t forget to ask about other costs associated with owning a home in that development, such as property taxes and the average utility costs. 4. What you see isn't always what you get It's normal to be fascinated by that picture-perfect model home, but don’t let it blind you. Model homes are, of course, decorated to look desirable and striking. They have been furnished and staged so that rooms will appear bigger. Model homes were often constructed using a mix of standard materials and fixtures and include many upgrades which don’t necessarily represent what you can get, so it’s crucial to note what exactly you will be getting. Enlist the help of your agent to get a list of the standard features and common upgrades, together with their associated costs. 5. Find other ways to negotiate and get discounts Most builders are reluctant to lower their prices because it may set a precedent for future buyers in the development who may expect similar discounts. The best way to negotiate with a builder is through upgrades. Consider asking for the builder to negotiate “on the back end,” such as paying for closing costs and performing upgrades at no additional charge. This is the less obvious way for builders to sweeten the deal while still maintaining the value of their neighborhood. With the help of your agent, research the builder's negotiating style so that you can plan for an effective way to make a creative offer. 6. Do your research to find a good lender and the best loan for you Consider other sources where you can find a lender who will offer you the best deal. Don't automatically use the builder’s own lender without shopping around for better options. Builders often have their preferred lender so that they can be fully informed of your personal progress as a borrower. However, they may not work with your best interests in mind. Your agent can also help you by referring his or her trusted list of private lenders where you can choose. For some instances where the builder’s preferred lender is the only option, find out if there are incentives, special offers, or competitive rates available to you if you agree to use the builder’s own lender. In some situations, it can be a cost-efficient option since they are often willing to offer competitive rates and terms, especially if the builder owns the lending company. 7. Get a home inspection You might think, “Nah, it's a new home, so why would I need to have a home inspection?” Well, that’s a huge mistake. New homes can also have problems or defects since construction workers can make mistakes as well. There may be problems with the HVAC or plumbing installation that only a licensed home inspector can detect. Getting an independent inspection is always a good idea since any problems can be identified before a builder’s warranty expires. It will also help you learn more about the home. A home inspection will guarantee that everything is safe and up to code. 8. Secure everything in writing Even if you are working with a respectable builder, make sure that everything you have negotiated and agreed upon will be included in writing. They may honor your requests, but verbal conversations are not binding so they may forget about the promises they made to you. Make sure that everything important will be put in binding documents that must be signed by all parties. It's especially crucial if you are buying a home that is not yet complete. Your experienced real estate agent can help you ensure everything is in writing and that all documents are properly signed. 9. Get a guarantee If you buy a home that is not yet completed, one thing you need to guarantee by the builder is a completion date, which should be specified in your purchase agreement documents. However, review these documents thoroughly because many builders may add provisions that make the completion date dependent on several variables, such as on city permit approvals or availability of building materials from several suppliers. A guarantee is especially important if you have to make living arrangements until the home is built. 10. Find out what things are included in warranties Last but definitely not the least: ask about warranties. Find out what is and isn't covered and for how long, since not all warranties are created equal. Most builders use third-party warranties that cover materials and workmanship. Builders often use construction materials from different manufacturers or suppliers, like for windows or tiles, so those products may have separate warranties. There’s a great chance the builder might refer all issues to the manufacturers instead of handling the issues directly. Get the builder to specify each product’s warranty information so you can prepare your offer documents to address any concerns before closing. Warranties will also help you understand the process you need to follow once something needs to be fixed. Buying a new construction home, with their absolutely perfect “new house smell,” can be considered a luxury of its own. Especially if you're the type of buyer who’s really dreaming of owning a piece of the American Dream in a particular development. Heed these smart tips and when in doubt, don’t be afraid to ask questions! Most builders and developers will use a handful of lingo and phrases you may have never even heard of. Ask questions if there’s something you’re unclear with, take down notes, and get everything in writing. Hopefully, you’ll have a top local realtor to educate and assist you in this important milestone.

Read More10 Thoughtful and Heartwarming Gift Ideas for First-time Homeowners

The spring real estate market is already here. Despite the strong competition, it's a great time for home buyers to score their dream home because of high market inventory. And soon, there will be fresh batches of buyers who have just finished closing and will soon be moving. Purchasing a new home is a big milestone for anyone, so welcome your friend or loved one to their new life with a thoughtful housewarming gift. It could be something practical, sentimental, or anything in between. Remember that they can have a list of things they are going to need for their new home but they might have a tight budget after paying the down payment and other costs, so a nice thoughtful gift will be appreciated. In case you need help in coming up with ideas, we’ve collected some of the best gifts you can give to new homeowners. If you’re still in doubt about what to choose, remember that it will always be the thought that counts. 1. Fresh flowers or a plant in a beautiful vase Who wouldn't love smelling a lovely bouquet of fresh flowers, especially if you’ve been surrounded by boxes and packages in the last few days? Brighten up their new abode with some colorful blooms that will be more attractive if you put them in a beautiful vase that new homeowners would love to keep. Studies have long established that flowers can help decrease anxiety and worries, so they can definitely help reduce moving-related stress. If you want to give something that will last longer than a bouquet, pick out a plant that is low-maintenance but could still add life to an otherwise empty space. Gift a succulent (which is a growing trend nowadays) in a cute vase, or go for a good luck bamboo or a snake plant. 2. A welcome mat A welcome mat can certainly make a new home feel pleasant and welcoming. Perhaps this is something they were planning to buy later, so you'd be doing them a nice favor by giving this simple yet thoughtful gift. You can always get something plain and basic. But if you want to make a lasting impression, go for a custom-made mat with their initials, a fun saying, or a quote that you know the homeowner would love. Yes, it will be better to pick up something beyond those that say “Welcome!” 3. Gift certificates or gift cards There's nothing more wonderful than receiving gift certificates for a certain restaurant or service. Since a new homeowner may still be overwhelmed with a lot of things to do, help them take a break by giving them a gift card for a nearby coffee shop or restaurant. It will allow them to get more acquainted with their neighborhood and discover new weekend favorites. Since packing and moving all require hard work, you could give them a certificate for a massage and spa to help them relax after all the hard work. 4. Tool kit/toolbox set Being a homeowner means getting ready for important home maintenance and repairs (as well as the costs!), so give them a set of essential hand tools, including a hammer, measuring tape, screwdriver, wrench, pliers and such. A toolkit can be especially useful for those who are moving to their very first home and have not immediately thought of acquiring most of these basics. You could also gift a humble set of gardening tools if you know the new homeowner has a green thumb and is now itching to tend to their garden during this spring season. 5. A spa-like gift set Scented candles and oil diffusers are one of the best housewarming gifts due to their aromatherapy properties. Candles can evoke feelings of warmth and relaxation and can be a nice addition to a new home. Choose a fragrance that the new homeowner loves and could help them relax, like lavender, vanilla, or eucalyptus. You can even personalize these candles by attaching a card or putting a lovely rustic packaging for that stylish look, then bundle them with a nice set of bath towels and aromatic soaps to complete that perfect spa-like gift set. 6. A fun household game There's no stress a fun game couldn’t relieve, especially for a young family who just moved in. It’s especially perfect for anyone who’s invited friends over to their new place. Bring in fun card games like Cards Against Humanity and Uno, or classic board games like Scrabble and Monopoly, that will surely be loved by the new homeowner and enjoyed by everyone. 7. A trinket dish or any lovely home decor Because not all gifts should have a functional purpose, why not give a trinket dish or any stylish home decor for a new homeowner who also aims to make his/her home “instagrammable.” Trinket dishes, decorative plates and bowls, and even marble coasters would look beautiful on a tabletop, mantel, or desk. Choose a decor with a natural but elegant design, and perhaps made out of unique materials like exquisite wood or marble. 8. Freshly baked goods and sweets Who can resist the smell of freshly baked goods and sweets? Especially if the homeowner has a sweet tooth, you can bake a fresh batch of sweets yourself and bring them over. Or, if you're not the type who loves to bake homemade goodies, head to a local bakery near their new place or pick up something from their favorite bakery in their old neighborhood. The aroma of those baked goods can certainly evoke special memories and make everything slightly better. 9. Cooking spices Since cooking spices and herbs are a staple in every pantry, why not give a starter set for the new homeowner, especially if he/she also enjoys cooking. It's both a flavorful and essential gift for any home cook. There are spice gift boxes already available in major supermarkets, so you can just wrap them up in lovely ribbons before giving them as gifts. If you’re a lover of homemade gifts, you can also get ideas online to help you create the perfect DIY spice mixes. 10. Cozy blanket A home wouldn't be complete without a cozy blanket. And since a first-time homeowner can never have too many of those, it can still be appreciated especially on cold nights where you only want to snuggle down and relax with friends and loved ones. Include a decorative or trendy pillow and you’ll be wishing a good night’s sleep to the homeowner who, after what could be years of house-hunting and surviving the stressful closing, finally have a place they can really call their own. If you're a home buyer or a new homeowner, you might as well share this with your family and friends, too! That way, they’ll have an idea of what to give you on your future housewarming party. Cheers and Happy Housewarming wishes in advance!

Read MoreHow To Sell Your Home And Buy One At The Same Time (Or In The Quickest Possible Succession)

For some people with enough funds and other houses to live in, selling a home and buying one at the same time can be relatively easy since there is not much pressure involved. But for those who need the equity from their old house to buy a new one, things can get quite stressful--especially so when they have no other place to go while trying to sell the house they're living in. Most people caught in this situation have a number of options at their disposal. However, one must be aware of the factors that should affect his or her decision. Below is a guide on how to successfully pull off this feat, depending on what scenario you might be in: Scenarios in which you have to SELL FIRST: Scenario #1: You're in a seller's market in which you'll be caught in a bidding war for the house you want to buy. In hot markets, it's unlikely for you to stand a chance in a bidding war if you make an offer contingent on the sale of your current home. If you’re up against multiple buyers, the best way you can stand out is to make a clean offer, with no contingency. Since you’ve already sold your home, you’ll have enough cash on hand to make this possible. The game plan: Find a reasonably priced rental with flexible terms, and stay there while staging your home to sell. Once you sell your home, use the money to make a clean offer on the house you want to buy. If everything goes well, you can move out of the rental in a few months. Scenario #2: You'll be moving to a new city in a few months. Whether it’s to start a new job, relocate with a loved one, or to accommodate any lifestyle change, you’ll be needing the money from your home equity to uproot yourself and start a life elsewhere. Besides, if you’re moving to a new city, it may be wise for you to rent a bit and explore different neighborhoods before buying your new home. The game plan: Declutter your home until it is adequately staged to sell. Be sure to find a buyer who will agree for you to stick around for a bit until you're ready to move to your new city. You can either negotiate a longer period until closing or offer to rent back your home for a few weeks. Find a short-term rental in your new city and use the time to begin your home search. Scenarios in which you have to BUY FIRST: Scenario #1: You're selling in a seller’s market, and buying in a buyer’s market. It is easy to buy a house where the market is slow since there won't be too many people to bid against on the house you want. If you’re in a hot market, you can quickly find a buyer for the home you’re selling, so it’s improbable that you’ll be stuck with two mortgages for longer than you can practically afford. In some cases, there won’t be anyone to compete with, and the seller may even accept an offer that is contingent to the sale of your home (also called a “contingency offer”). This way, you won’t have to worry about paying two mortgages at the same time. The game plan: Start staging your home to sell long before you plan to move out. This way, it can sell quickly once you put it on the market. Make an offer on the house in the area you'll be moving to. If you’re making a contingency offer, negotiate a 30-day contingency period. If not, consider using an escrow account to secure the offer while waiting for your home to sell. Put your house on the market once your offer on the new house has been accepted. While this is highly unlikely to happen in a seller’s market, it is wise to consider a bridge loan if it takes you awhile to find a buyer. Scenario #2: You have enough resources to make an offer NOW, even while your home for sale is still on the market. Not many home buyers find themselves in this position, given that most people are only capable of making a down payment on a new home once they have already sold the previous one. However, for those who have the money, consider these: If you buy first, you can immediately move to your new home and have your previous home staged and presented in its most appealing state. If you do an impressive job on this, you can get an excellent offer on your home by marketing it vacant and ready for occupancy. You'll only have to move once! No more looking around for a rental unit or storage space. You can be more at ease knowing that you already have a home that is yours to stay in while dealing with the stress of selling your previous home. The game plan: Gather your funds from the sources you have in mind, and make a solid offer on the house you want to buy. Move into your newly purchased home and stage your previous house to sell. Once your home sells, pay back the accounts you've tapped by using the money you earned from the sale.

Read More3 Most Important Things To Remember When Selling A Home That You Still Have To Live In

luxury of living elsewhere while selling the house they do have. It's pretty common for home sellers to have to deal with the challenge of selling the same home in which they still have to eat, sleep, and bathe in -- so it’s nothing to be embarrassed about. However, it can be quite a challenging feat, and it can cost you a lot if you don’t pull it off seamlessly. Below are the top three (3) things you have to do to keep the situation under control and not hurt your chances of getting a good offer. Keep them in mind if you want to breeze through the sale with as little setbacks as possible. There are a lot of things you can achieve by simply starting to pack up your things. One of them is making things easier for you once you need to move out of your house for real. Packing is an activity a lot of people dread and end up procrastinating on. Even just packing your suitcase for a vacation can seem stressful when you do it at the last minute, so just imagine how much stress it would cause you to pack up everything you own! So our advice is to pack ahead and stow away things you won't be needing in the near future. For example, if winter isn’t coming anytime soon, start packing away those thick jackets and sweaters. Put them in a storage unit or a relative’s garage. Another advantage of packing up early is being able to depersonalize your home. Most potential buyers are turned off by a house that feels too unique or too individualized. If they can’t picture themselves living in your home, they will definitely feel out of place and lose interest in buying. So this is as good a time as any to start taking down family portraits from the walls and wrapping them up so you can safely transport them when the time comes. And lastly, it’ll give you another chance to experience living in a spacious and uncluttered house again (at least until the offers come in). It can even inspire you to permanently rid your future home of all of the unnecessary clutter you had to pack from your old one. Yup, this means a general cleaning of your home unlike anything you've ever done in the past months, or even years. It is the kind of cleaning that will take you days to complete, lest you opt to pay extra for professional cleaners that can have it done for you in a day. This may sound like a huge undertaking, but there are a lot of upsides to it as well. AND, you only have to do it once. Once your house is thoroughly cleaned and practically spotless, it’s easier to just keep it that way until it gets sold. If you have the budget to spare, we highly recommend that you hire professionals to clean every part of your home, including all the nooks and crannies. Years of living in a house (even one that you regularly clean) can build up so much more dirt than you can imagine, so it’s better to leave all the comprehensive cleaning to professionals. Of course, you can’t hire people to keep your home at this level of cleanliness every single day. The trick is to come up with a system with your family about how you’ll go about living in a house which you are already selling. Entail the help of each member of the household by reminding them to cover all tracks of their activities. Wash dishes immediately after use, do the laundry at night so it doesn’t distract viewers during the day, and clean up everything the night before. While you want to be as accommodating as possible, you also have to look out for yourself. Potential buyers are always going to inspect every area of your house—this means opening drawers, cabinets, and taking a close look at your garage and storage rooms. If you still have to live in your house while it's being shown to potential buyers, it’s understandable to still have a few personal belongings inside. However, it would be wise for you to safeguard all valuables and belongings with sensitive information. Keep them in a locked drawer or a safe, and keep them in a room where people don’t tend to gather. Don’t keep any gadgets lying around, and make sure your computers have strong passwords. As always, keep in close contact with your real estate agent and ask them for their feedback as well.Best of luck, home sellers!

Read MoreWhat's In A Mortgage? Breaking Down the Components of A Mortgage Payment

In simplest terms, a mortgage is a long-term loan designed to help borrowers purchase a house. It allows individuals to become homeowners without making a large down payment and thus, fulfilling The American Dream. Once you become a homeowner, a mortgage represents one of your life's biggest financial commitments. So it’s important to understand the structure of your payments — what percentage goes to principal, interest, and taxes, and what you currently owe on your loan balance. I'm a first-time home buyer. Once I closed on my new home, when will my mortgage payment start? Mortgage payments usually start one full month after the last day of the month in which the home purchased closed. Unlike rent payments, which are usually paid in advance on the first day of the month, mortgage payments are paid in arrears. It means the payment is expected to be made at the end of the month. For an instance, after closing on your new home on March 28, the first full mortgage payment, which is for the month of April, is then due on May 1. 2 primary factors to determine your monthly mortgage payments Size of the loan - refers to the amount of money borrowed. Term of the loan - the length of time within which the loan must be fully paid back. Remember: Longer terms result in smaller monthly payments. This is why the 30-year mortgage remains the most popular mortgage financing option among many home buyers. Remember PITI: The 4 Major Components of a Mortgage Payment PRINCIPAL The actual amount of money you borrowed from the lender without the interest. It is the face value of your mortgage on the first day. For an instance, if your mortgage is $250,000 with a 4.5% interest rate, your principal remains at $250,000. A portion of each mortgage payment goes to the repayment of the principal. If you take a mortgage with a fixed-interest rate, your principal repayment will be the same for the life of the loan. A greater amount of the principal is paid during the back half of the loan because the majority of the payment in the first few years goes primarily to interest. To calculate your starting principal balance: Principal Balance = Purchase Price + Fees Rolled into Mortgage - Down payment INTEREST The interest is another big part of your mortgage payment. It is basically the profit that goes to the lender. Think of it as the lender’s reward for taking a risk and lending money to a borrower. Lenders will want to earn their interest back in the first few years of the loan repayment before they start reducing principal. Meaning, the majority of your mortgage payment goes to the interest in those first few years, but every month you pay down a little bit of principal as well. This is the method banks use to protect themselves in the event of a default. But the more payments you make, the lesser amounts goto interest and a bit more goes to the principal. For a 30-year loan, the first seven years will go mostly towards the interest. Higher interest rates = higher mortgage payments Interest is accrued annually regardless of whether you have a fixed-rate mortgage or an adjustable-rate mortgage. It’s important to note that the interest rate on a mortgage has a direct impact on the size of a mortgage payment. The average 30-year fixed-mortgage rate until March this year is 4.54%, which rose slightly higher since November 2017. To calculate how much of your payment goes to interest: Interest Portion = Current Principal Balance 𝒙 (APR ÷ 12) Side Note: What is amortization? Amortization is a sliding scale that shows how much of your monthly mortgage payment is going towards principal and how much is going towards interest. It also includes a breakdown of every payment for whatever term you select. To have an idea of where your monthly payment typically goes, visit your lender’s website and print off a copy of your amortization schedule. There are also free amortization schedule calculators online that you can use as a guide to estimate the monthly payment on your mortgage. TAXES Almost all lenders require you to include, or escrow, the taxes into your monthly payment. It is because property taxes take first priority over everything else. The tax portion of your payment could vary from year to year depending on the town where you live and your property’s value. Real estate taxes are assessed by governmental agencies and used to fund various public services, including the school district, road construction, the police and fire department services, and others. The amount that is due in taxes is divided by the total number of monthly mortgage payments in each year. If you escrow, you place the next tax payment in advance with your lender and they pay the taxes for you. If you have an extra amount in your escrow account at the end of the year, your lender may cut you a check and then simply roll it over to next year. INSURANCE Insurance payments, just like property taxes, are also part of each mortgage payment and held in escrow until the bill is due. This is done to ensure that you are always covered in the event of an emergency. The taxes and insurance typically don’t experience much fluctuation, unless there is a run on foreclosures or if your neighborhood was hit by weather issues, then it could change significantly. Common Types Of Mortgage Insurance Included in Mortgage Payments Private Mortgage Insurance (PMI) This type of insurance is mandatory for homeowners who purchased a home with a down payment of less than 20% percent of the home’s purchase price. It protects the lender from financial loss in the event that a borrower defaults on the loan. The rates for PMI differ from loan to loan and depends on several factors, including the borrower’s credit and the amount of down payment. Typically, this insurance costs between 0.3% to 1.15% of the mortgage loan amount. For most conventional loans, the payment for PMI is necessary until you have at least 20 percent equity in your property. A borrower also has the option to choose from different payment plans: annual, monthly, and upfront payment. Homeowner’s Insurance This is a form of property insurance that covers losses and damages to an individual’s house and assets in the home. It also provides liability coverage against accidents in the home or on the property. Homeowner’s insurance is often bundled with mortgage payments. It’s important that homeowners educate themselves on the amount of their homeowner’s insurance premium every month. Mortgage Insurance Premium (MIP) in FHA Loans The MIP is an insurance policy used in FHA Loans. It protects lenders against losses that result from defaults on home mortgages. In an FHA loan, both upfront and annual mortgage insurance are required for all borrowers, regardless of the amount of down payment. Borrowers can check the annual MIP rates on the FHA website.

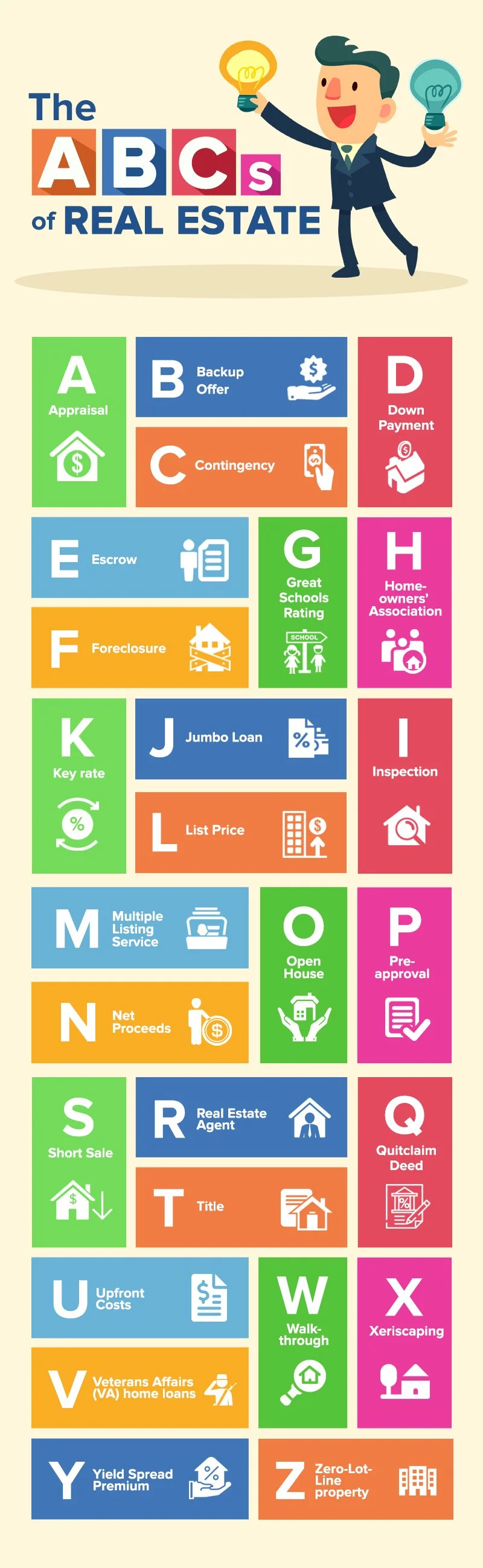

Read MoreThe ABCs of Real Estate: Real Estate Terms Every Buyer And Seller Needs To Know

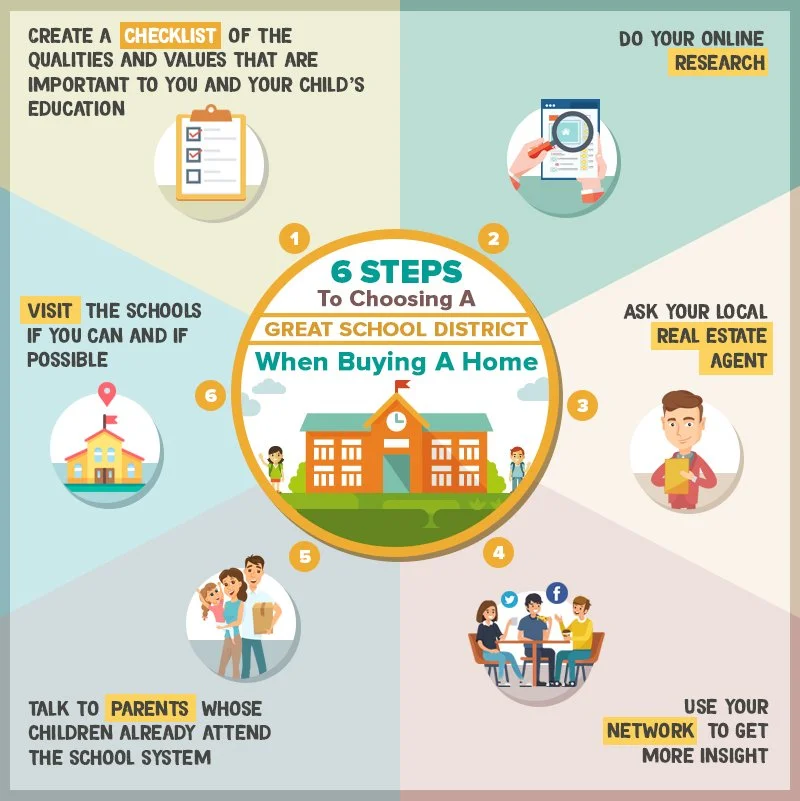

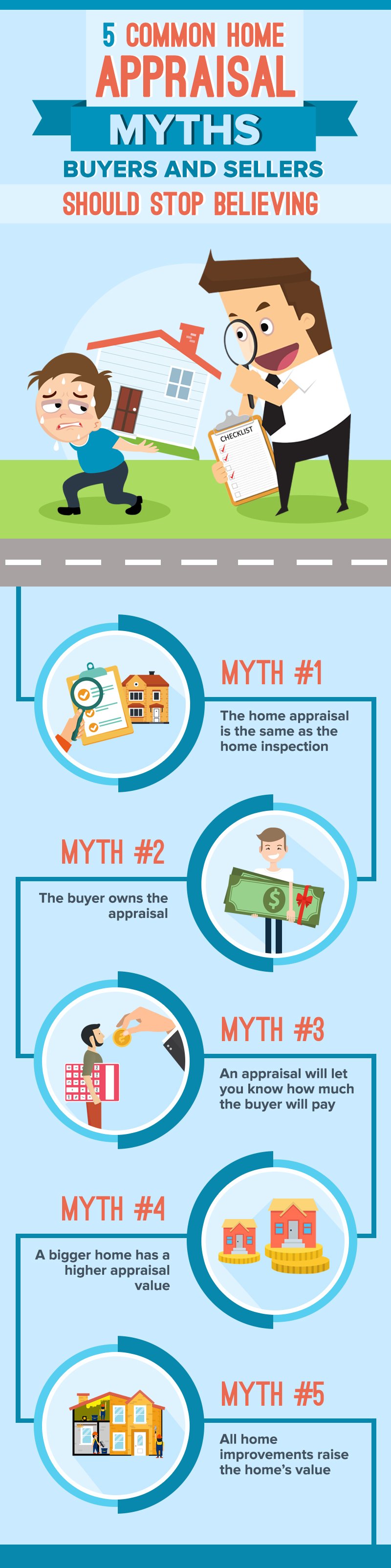

Whether you are a first-time home buyer or a third-time home seller, the real estate transaction can be confusing and stressful enough even without the many terms and acronyms used during the process. But don't be overwhelmed — we’ve compiled a mini-glossary of the important terms you should know and familiarize yourself with to help you better understand what’s going on with the home sale. It’s good to remember what Steve Jobs said: “There’s always one more thing to learn.” The ABCs of Real Estate A: An appraisal is a professional estimate of the value of the property by a certified appraiser. Lenders always require a home appraisal before they will issue a mortgage. Appraisers look into similar homes in the area that have been sold recently, also known as “comps,” and also take into account the home's condition, square footage, location, and quality to make an accurate assessment of how much the home is worth. There are many myths surrounding the home appraisal that buyers and sellers should be aware of to better understand this valuable process. B: A backup offer is a secondary offer on a home that is under contract between the first buyer and the seller. It becomes active when the primary sale falls through due to a number of reasons. A backup offer can be a useful tool to keep a buyer motivated to get the home that he/she wants. C: A contingency in a real estate contract is anything that puts a condition on the buyer’s willingness to proceed with the purchase. Some of the most common contingencies include the financing contingency, inspection, sale, title, and appraisal contingency. A buyer will typically reserve the right to recover her earnest money if the contingency is not satisfied. D: Down payment is the amount of money a home buyer pays directly to a seller and ranges between zero to 20 percent of the home’s purchase price, depending on the type of the loan. In the 2018 NAR Aspiring Home Buyers Profile, many home buyers have indicated that the most difficult step in the home buying process is saving for a down payment. However, there are popular loan assistance programs that can help buyers afford a mortgage, including the FHA loan, where buyers can get a mortgage with as low as 3.5 percent down payment. Likewise, the VA and USDA loans require no down payment at all for eligible home buyers. Bonus: The Debt-to-income ratio (DTI) is a personal finance measure that compares an individual’s debt payment to his or her overall income. A low debt-to-income ratio demonstrates a good balance between debt and income. Borrowers who have lower DTIs are more likely to successfully manage monthly debt payments. Reducing your debt-to-income ratio can help improve your credit score, which lenders will evaluate when you’re applying for a mortgage loan. E: Escrow is a term for a neutral third party that handles the exchange of money and documents (purchase agreement, deed, loan documents, etc.) in compliance with the Purchase and Sale Agreement and any escrow instructions. Escrow handles the transfer of the buyer's loan documents and property taxes and works with a buyer's lender and real estate agent to make sure the title of the home is clear of liens before the transfer of ownership. Bonus: The Earnest Money Deposit is the money a buyer pays soon after a home seller has accepted his/her offer on a home, and is different from a down payment. Once the sale of the home has been completed, the earnest money the buyer paid will be applied toward the closing costs. If the buyer backs out of the sale due to a failed contingency, he/she can recover the earnest money in full. However, if the buyer backs out of the sale for reasons not covered by contingencies, he/she will forfeit the earnest money. F: Foreclosure is a process that transfers the right of home ownership from the owner to the bank or lender after the owner defaults on his loan. Bonus: For-Sale-By-Owner, more commonly known as FSBO (pronounced “fizbo”), is used to describe a homeowner who is selling their property without the help or representation of a real estate agent. FSBOs remain at an all-time low of 8 percent, according to the NAR 2017 Profile of Home Buyers and Sellers. At least 89 percent of home sellers continue to work with real estate agents to sell their homes. G: The GreatSchools Rating by GreatSchools.org provides essential information to parents so they can choose the right school for their family. Since proximity to good schools is a major factor especially for buyers with children and young families, the GreatSchools Rating is a helpful tool for parents in evaluating the schools and school district they’re considering. H: Homeowners’ Association (HOA) is a nonprofit organization that manages a shared housing complex, including condos and other planned developments. The HOA provides funding for repairs, grounds maintenance, and security by collecting money from homeowners. It also creates and enforces rules for the properties. I: An inspection, or typically known as a home inspection, is a thorough investigation of a property’s condition by a licensed inspector. It is the home inspector’s job to assess the condition of the property and look for any flaws that need to be fixed, even if a house looks like it’s in great condition. J: A jumbo loan or jumbo mortgage is a loan whose principal value exceeds the standard limits for Fannie Mae or Freddie Mac, the two government-sponsored enterprises that buy loans from banks. This type of loan is available for borrowers who do not qualify for a conforming loan and is commonly used for luxury homes. K: Key rate refers to the specific interest rate that determines bank lending rates and the cost of credit for borrowers. In the US, the two key interest rates are the discount rate and the Federal Funds rate. L: List Price is the price of a home for sale set by the seller and his/her listing agent. Real estate agents help set the price of the home right by doing a Comparative Market Analysis (CMA) to provide an accurate home valuation. Setting up a correct list price won’t turn off potential buyers and increases the chances of the home getting sold. M: The Multiple Listing Service (MLS) is a suite of around 700 regional databases, wherein each regional MLS has its own listings. Agents pay dues to access and post homes on each one, and they may become a member of more than one MLS if they want to have a broader reach for their clients. Only licensed real estate agents and brokers can list homes for sale on the MLS. N: Net Proceeds is the amount of money a seller takes away from selling a home, after taking into account the agent commissions and closing costs. O: Open House is an event where a house or property is open for viewing to potential buyers for a scheduled period of time. Many open houses occur on weekends, especially on Sundays. P: A pre-approval is an evaluation of a potential borrower by a lender that determines whether the borrower qualifies for a loan. During the process, a lender will evaluate the income and expenses of the borrower, including taking a thorough look at the borrower’s credit report and score. Getting a mortgage pre-approval is the first step serious first-time home buyers should do before they even go house-hunting. It will provide buyers a crucial guideline of what loan they can get, how much they can afford and how much the bank will lend them. Q: A quitclaim deed is a legal document that transfers ownership of a home from one party to another, but does not give any guarantee as to what is being transferred. It simply transfers whatever interest the homeowner has in the property to his/her recipient. For an instance, a quitclaim deed can be used by a divorcing couple if the husband needs to transfer their jointly-owned property entirely to his wife. R: A real estate agent is an individual who is licensed to negotiate and arrange real estate sales; including showing property, listing property, filling in contracts, listing agreements, and purchase contracts. Real estate agents are generally licensed to operate under the supervision of a real estate broker. In the NAR 2017 Profile of Home Buyers and Sellers, at least 89 percent of home sellers worked with a realtor to sell their home, while 87 percent of buyers purchased their home through a real estate agent. Especially for first-time home buyers, hiring a great real estate agent can help you save time and resources on your journey to purchasing your dream home. S: A short sale happens when an owner is selling their home for less than the mortgage they owe on it. The lenders may agree to take a “short” on the mortgage to release it for sale. A short sale is typically seen as the last step before a foreclosure. It often happens after a low appraisal or a decline in property values. T: Title is the right to ownership of a specific real estate property. Once the transaction closes, the buyer will receive a final title policy recording their names as the new legal owners, along with the amount of title insurance. The most common methods of holding title in real estate are the joint tenancy, tenancy in common, and sole ownership. U: Upfront Costs refers to all the costs a buyer pays once his/her offer on a home has been accepted, including earnest money, the inspection fee, and the appraisal fee. V: The Veterans Affairs (VA) home loans are unique mortgage options for current and former members of the military, offered by the U.S. Department of Veterans Affairs. Veterans, active-duty service personnel, select Reservists or National Guard members, as well as spouses of military members who died while on active duty, are among those who can qualify for this loan. The VA provides a home loan guaranty benefit and other housing-related programs to help them become homeowners. W: Walkthrough refers to the final inspection of a home before closing. Buyers should complete a final walkthrough with their real estate agent to make sure any agreement to make repairs on the property have been fulfilled before the closing papers are signed. X: Xeriscaping is a creative and sustainable landscaping that conserves water and is based on sound horticultural practices. The process was originally developed for drought-affected areas and is best for areas with water restrictions. In xeriscaping, the need for maintenance is minimal and water requirements are low. The practice relies on using local plants accustomed to the climate and getting the most out of everything you plant. Homeowners can lessen the impact on their local environment by creating this type of sustainable landscape. A good xeriscape can also raise property values more than extensive landscaping. Y: A yield spread premium (YSP) is the compensation a lender pays a mortgage broker to sell a loan with a higher interest rate. The YSP is listed on the loan estimate and Closing Disclosure. Z: A zero-lot-line property is a building that comes to the very edge of the property line on at least one side. Units may be attached to one another in a zero-lot-line housing development, leaving no room for a yard. Many townhouse developments are built on zero-lot-lines.

Read MoreSelling Your Home? Here's How You Can Upgrade Your Kitchen On A Budget

The kitchen is one of the most important areas in a house. If a potential buyer is someone who spends a lot of time in the kitchen, the condition of this area can make or break a sale. In fact, even if the buyer is not much of a cook, the kitchen is still a major consideration since this is where friends and family tend to gather--especially if it opens directly into the dining area. You may be thinking, "But I don't have money to spare for a major kitchen renovation!" This is a common sentiment among sellers, and for good reason! Kitchen renovations are known to be costly--with some reaching over $80,000. But then, you don't really have to do a comprehensive overhaul to make your kitchen look good as new. With a few tips and tricks, you can transform the look and feel of your kitchen for under $5000 (total)! If you feel that this is still a huge sum of money, just think of it as an investment. Many potential buyers are willing to pay good money for a kitchen that stands out in terms of cleanliness, design, and function. Besides, your alternative is to keep it as it is, and if the current condition of your kitchen is a dismal one, this may drag down the value of your entire house. Below are a few things to consider if you really want to upgrade your kitchen without breaking the bank. Refer to the image and corresponding number! 1. If you're on a tight budget, make sure to come up with an actual amount and stick to it. Only replace kitchen parts that absolutely need to be replaced. If they're not faulty or extremely old, you can simply resurface, repaint, or clean them. 2. When renovating your kitchen for resale, resist the urge to incorporate too much of your unique tastes. An overly personalized design leaves no room for the imagination, which may turn off potential buyers who don't share your taste. Remember that your goal is to sell, so choose kitchen materials and colors that would appeal to a wide range of people. If you decide to repaint the walls and cabinets, do so with a neutral color palette in mind. For kitchen items, stick to minimalist designs with a modern feel. 3. Start with your kitchen's main workstations. Replacing countertops with new granite slabs can be too expensive, so opt instead for granite tiles. You can cut down the cost even further by simply re-grouting your existing countertop tiles. Just remember to bleach off any stains, and make sure that all surfaces are completely dried up and squeaky clean during the viewing! 4. The sink is one of the first things people notice in a kitchen, so keep yours clean and polished at all times. It also goes without saying that your faucet must be in tiptop shape, without the ugly white buildup that usually form on kitchen fixtures. If you don't see the need to replace your old faucet, a tried-and-tested trick to make it look brand new is to wipe off the buildup with lemon juice or secure a plastic filled with vinegar around it using a rubber band. Be careful though, as vinegar may damage iron or nickel fixtures. 5. Replacing old knobs and pulls for your cabinets is also a cheap way to upgrade the entire look and feel of your kitchen. Again, choose simple designs that have a general appeal! If you tend to be a little adventurous when it comes to styling your home, ask a few friends (whom you trust to have good taste) to go shopping with you. 6. If you have wooden cabinets, consider stripping the finish and restaining the painting instead of resurfacing each one. This would cost you much less, but will have the same dazzling effect. 7. While the look of your kitchen is the first thing that people see, you must also take note of how it feels to be in it. Some questions to ask: a. Is it adequately lit? Use the windows to bring in enough sunlight, or compensate with artificial lighting if you're a bit short on natural light. b. Is it well-ventilated? Range hoods are great for improving air circulation, but can also be a bit costly, so put up a window fan instead! c. Is there enough space to move around? While you can’t increase the area of your kitchen, you can get rid of unnecessary clutter to make the room feel bigger. 8. Beautiful flooring may be the most expensive thing you'll need to work on in your kitchen, but it’s always worth it when you do it right. New hardwood flooring can get most potential buyers drooling, but it’s a difficult one to achieve if you’re on a budget. The good thing is there are a lot of less expensive alternatives you can use, such as cork flooring or vinyl and porcelain tiles. Explore your options and go for the one that is within your budget. 9. Keep all appliances sparkly clean and free from odor. No one is going to remember your new granite countertop if your refrigerator still contains leftover food and is covered in tacky stickers and magnets. When staging your kitchen, it is important to clear out your cooking appliances and make them look their best. You should do this even if the items aren't included in the sale. As long as they’re still in your kitchen, they must be in their best condition for viewing.

Read MoreTop 5 Things Home Buyers Forget To Check During Home Viewing