MOST RECENT BLOGS

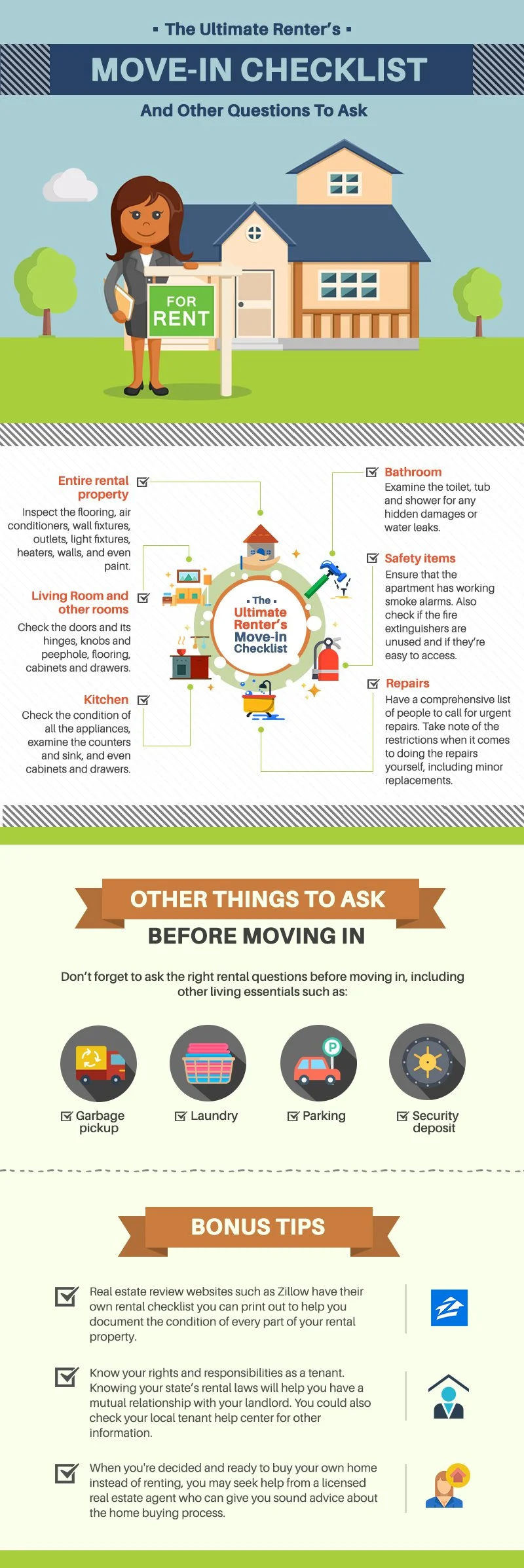

The Ultimate Renter's Move-In Checklist (And Other Questions To Ask)

Despite the many disadvantages of renting compared to buying one's own home, many are still choosing the former because of increasing home prices and high mortgage payment and taxes. In the 2016 American Community Survey of the Census Bureau, nearly 37 percent of U.S. households are now renter-occupied. Certainly, more U.S. households are now renting that at any point in 50 years, since 1965. However, there’s more to renting than finding your ideal apartment, signing the lease and exchanging the keys. Before moving in, you have to sort out the major issues, thoroughly check the rental property, and ask the necessary questions that will help your life as a tenant become peaceful and sustainable. One of the most important things a renter certainly needs is a move-in checklist. The move-in checklist may be one of the basics, but it's still an essential document a tenant could have before moving in. “The move-in and move-out checklist is a convenient, all-inclusive and reliable way to document the property’s condition,” writes Joe Killinger for MultifamilyInsiders. “Residents can benefit from a move-in checklist because any existing conditions will be predated to his/her occupancy. This checklist helps the property manager by reducing liability risks due to disagreements related to security deposit reimbursement; thus, protecting the value of the property.” Remember that each room of the property needs to be addressed and documented separately. It is advisable to take pictures and even videos of each part of the property as it will provide a timestamp of its condition before you move in. The important things to check include: Entire rental property - Closely inspect the flooring, air conditioners, wall fixtures, outlets, light fixtures, heaters, walls, and even paint. Living Room and other rooms - Check the doors and its hinges, knobs and peephole, flooring, cabinets and drawers. Kitchen - Care to check the condition of all the appliances, including oven, fridge, dishwasher and others. Examine the counters and sink, and even cabinets and drawers. Be vigilant for any water damage and leaks and make sure it's inspected and repaired before moving in. Bathroom - This is where we pamper ourselves, so make sure to inspect the toilet, tub and shower for any hidden damages or water leaks. Safety items - Ensure that the apartment has working smoke alarms. It is the landlord's responsibility to repair any damage to the alarms or replace the batteries if they're running low. It is also important to check if the fire extinguishers are unused and if they are located in areas that are easy to access. Repairs - Have a comprehensive list of people to call for urgent repairs, and take note of the restrictions when it comes to doing the repairs yourself, including minor replacements. Aside from inspecting the physical condition of the rental property, knowing the right questions to ask before moving in is very important. These may include other living essentials such as: Garbage pickup - Never forget to ask where the trash goes, how often is the garbage collection in your area, as well as the rules on packing and segregation. Laundry - Keep in mind the operating hours for your building's laundry room or the washer and dryer area. Parking - Ask whether the parking spaces are open to all residents or assigned to each tenant. Security deposit - You should know the full requirements for your security deposit, how it will be collected and refunded, and the amount required depending on your lease. In California for example, a landlord may charge a renter the equivalent of two months' rent for the security deposit if the residence is unfurnished, and three months' rent if the residence is furnished, under the state's landlord-tenant laws. Bonus Tips: Real estate review websites such as Zillow even have their own rental checklist you can print out to help you document the condition of every part of your rental property. Know your rights and responsibilities as a tenant - Each state has their own rental laws or tenants’ rights, laws and protection, and some may be more robust than the others. Knowing your state’s rental laws will help you have a mutual relationship with your landlord. Brian Sullivan, a spokesman for the U.S. Department of Housing and Urban Development, also suggests for renters to check their local tenant help center. Nevertheless, when you become tired of renting due to increasing rates, non-refundable deposits, or even just dealing with your landlord every now and then, one way to protect yourself is to lock in your housing expense and buy a home instead. When you're decided and ready, you may seek help from a licensed real estate agent who can give you sound advice about the home buying process.

Read MoreEMPTY NESTERS: Top 5 Reasons Why It Could Be Wiser To Sell Than To Renovate

It may seem like a daunting task to sell your home rather than to renovate – the process looks tedious, and you and your family may have emotional attachments to your home. But there are a lot of pros that side with selling your home that you may not know or may not have considered. 1. Home renovation actually costs a lot more than you think! If your home has been sitting for too long, it could actually cost less monthly when you purchase a new home. Also take into account the amount of equity you hold and the types of renovations you're considering. According to Rob Caulfield, director of Archicentre, the building design and advisory service of the Australian Institute of Architects, renovating more than 50% of a home has to be made to comply with current building regulations. This could possibly mean getting new wiring, plumbing, and new energy rating – so basically a whole part of the house may need to be insulated and the cost can be quite hefty. Take note that you may also need to hire professionals and that a contingency fund for cost and time overruns are necessary. If you intend on financing renovation costs, use a mortgage calculator to determine just how much your existing mortgage and a renovation loan/ home equity loan or line of credit would cost versus a new home mortgage. 2. There are little returns to renovating your home. No matter how good you think your renovations will upgrade your home, keep in mind that no renovation will produce a 100% return. Based on a recent study, you will recoup only 64.4% of a remodeling project's investment dollars if you do sell in the future. So if you do plan to sell, just prioritize the important parts of the home that need fixing such as the roof, the kitchen, and plumbing. 3. A new home environment entails a fresh start at life. If you've stayed in a single area in a long while, you may be feeling burnt out with seeing the same spaces every day. Sure, the familiar is comfortable, but moving to a new place may give you and your family a refreshed perspective because you’re now located in a different living space. Another noteworthy benefit of selling and buying somewhere new is you can accommodate the current, and future, needs of your family without going through the mess of renovating. 4. Renovating can be a major hassle. Take inventory of your skill set and ability to manage and deal with contractors, as well as renovation costs for major renovations. If you haven't done all these before, there may be a lot of room for budget overruns and unexpected complications. 5. You might just come across your dream home. If you get an agent that can help you sell your house and hook you up with ones that fit your family's wants and needs, you might just get a hold of your dream home without all the hassle and hefty costs of renovation. Sure, renovation can be a good idea, too. But don't dismiss the chances of you getting a better deal by selling your house instead. Talk it over with a professional baefore making your final decision.

Read More7 Tips To Sell A Good House From A Challenging Location

When the house you're about to sell is in a location that’s not entirely ideal – meaning it’s placed near main roads with heavy traffic or it’s susceptible to pollution due to proximity to factories or airports – it could negatively affect your market value. But keep in mind that all hope is not lost – here are a few ways you can sell your property. 1. Find a good real estate agent. A good and experienced real estate agent can give you sound advice on the measures you can take in order for you to sell the house with as little cost as possible. He/she could also present your house to clients in positive ways that you might have overlooked. 2. Direct potential buyers to the most attractive route to your house. Help them find the most interesting areas around your neighborhood. When you give directions, mention nearby shopping areas or parks as landmarks. 3. Boost your curb appeal. A nicely mowed lawn with lush grass and plants and a clutter-free yard will surely send out a good impression on your clients even before they get their foot on your door. 4. Spend as little as you can on home improvements. Let's face it: there’s a big chance that a buyer would ask you to lower your price, and if you splurged on unnecessary home improvements, that could lead to a big loss on your part. Here’s a list of cheap home improvements you can make to sell your house fast. 5. Find the best time of the day to schedule open houses. If your house is in the same street as a school or a string of commercial properties, don’t have your clients come to your house at a time when the traffic of people and cars are at their worst. Schedule your open houses wisely so you’d have more time to prepare. 6. Use problem areas to your (and your client’s) advantage. You can’t certainly hide the problem areas from your clients, but you can turn the tables (or you can brief your agent) by telling your clients how these could benefit them. For instance, if your house is near a school, you can tell them that this could help them keep a closer eye on their kids. Or if it’s situated in a busy streets with a lot of traffic and activity, home break-ins would be least likely to happen. Here's a bonus tip of you really need to sell the house quick: Give concessions. If the neighborhood is really not in top shape, some buyers would ask for compromise – they could ask you to lower your price, or to shoulder most of the closing costs. Discuss with your agent just how much concession you could grant without selling yourself short.

Read MoreTips for Empty Nesters and Why Downsizing Your Home Could Mean “Living The Dream”

While owning a home remains the American Dream, “aging in place” or staying in one's own home as you age is also considered part of it. However, staying at your bigger home isn’t always the best option. And as you get older, downsizing or settling into a smaller home could also be one definition of “living the dream” and aging in place. Older Americans, more of whom are homeowners, are now more likely to downsize. At least 37 percent of baby boomers said they plan to move at some point in their life, and 42 percent of that number said they would prefer to live in a smaller home, according to a 2016 study released by the Demand Institute, which is jointly operated by the Conference Board and Nielsen. In an article by Time Magazine, the current US housing market is said to have more good news towards the empty nesters and homeowners who are looking to downsize, so many are calling it the “empty nester’s housing market.” Builders and developers are now catering to the 55+ crowd or the Baby Boomer market, creating more age-restricted communities, compact townhouses, and even high-service luxury condominiums. SO WHAT DOES IT MEAN TO DOWNSIZE? While downsizing may be daunting at first, it offers many financial and emotional benefits in the longer run. People who are taking the proactive approach see and do it out of necessity, choosing to downsize before they get older and it becomes more difficult to do so. Offers many financial advantages. While your six-bedroom farmhouse with a spacious garden holds so many memories of your children, maintaining it now takes time and has larger costs compared to living in a two-bedroom flat. Downsizing means there are fewer maintenance costs, cheaper utility bills, or even lower taxes and monthly mortgage costs. A smaller house also undoubtedly has fewer rooms to clean. This is a great chance to increase your retirement savings and allocate this fund for other better investment options, or you can even spend more time in travel and vacation. You can focus more on your lifestyle and well-being. Especially in age-restricted communities and luxury condominiums, the focus is not only on the accessibility of the place to main city places and attractions, but it's more lifestyle-oriented as well. These communities offer a wide selection of homes and resort-style amenities and better accommodate active retirees, making them ideal retirement destinations. You can focus more on engaging yourself in new activities and hobbies you’d always been dreaming to do. Best for any of your health concerns. While we always say that we’re “as young as we feel,” we may encounter some health problems as we age. There are many housing options if you want to avoid going up and down the stairs because of arthritis or fear of falling when doing your own cleaning. You could also choose a home that’s near a clinic or hospital if you want a shorter trip to your next medical appointment. Here are some tips to make downsizing “rightsize” and a positive experience: Seek help from an agent who specializes in senior home purchases. The purchase process itself for this kind of communities is not much different from any home purchase, except that there's a level of detail in selecting a home that allows you to live exactly as you want. There are real estate professionals who are downsizing specialists and have profound education in senior housing and the moving process for older adults. Be assured that your housing options are not limited. Whether you're looking into moving to a smaller home, an age-restricted community, or even into assisted living, remember to choose a home that meets your needs and current lifestyle, where you’ll be more comfortable and happy. Set a definite but realistic timeline. Unlike when buying your first house, looking for a perfect smaller home or an age-restricted community may take longer than expected. There are websites that specialize in providing active-adult community information to help with your search. Many people are also starting to look for these areas two or three years before making a purchase. Just remember that you are now looking for the perfect location and community that suits your needs. Minimize your storage by knowing what you’ll own and what you can throw away. Downsizing also means you'll have lesser storage space, so you’d want to keep only the things you need. You can opt to sell, donate and throw some items you have accumulated over the years, and just keep those that you deem valuable or those things that have increased their value over time. Experts also recommend doing an estate sale once you’ve sorted out your items, so you’ll be able to collect money as well. If you’re having a hard time to let go, just remember that the true memories and experiences you’ve had are indefinitely stored in your mind and heart and not in these physical items.

Read MoreTo Rent Or To Buy: Top Things You Should Know

Buying your own home seems like the fulfillment of the American dream, but as housing prices are increasing, we all know that that dream will definitely cost you a hefty amount. According to an article on Economists' Outlook, the median price of homes for a single-family home sold in August 2017 is $255,500, which is a 5.6% spike from last year. Many people would resort to renting, but is that move really cheaper than buying a house? Let’s first weigh the pros and cons of buying a house and renting one. Take note that renting prices have also gone up and buying a house would generally be cheaper than renting in states belonging to the Northeast, South, and Midwest regions. But it's good to remember that there are multiple factors to consider other than just price.

Read MoreTop 5 Reasons To Sell Your Home NOW

If you have been wanting to sell your house for a while but just couldn't get into favorable conditions, 2018 is an opportune time to sell it. Here are the top 5 reasons why: Reason #1: Low inventory If you know about the concept of supply and demand, you'd know that when something is in short supply, its value tends to increase. The REALTORS® Confidence Index Survey showed that low inventory in the homes for sale has been a major issue affecting transactions. This puts sellers in a position of advantage because as the number of homes for sale is low, the value of those that you could put up for sale will swell. You could also take note that Historical NAR data shows that housing prices appreciate by 5% when supply falls below 6 months. That means that you could expect the median prices for housing to be higher. Reason #2: Stronger job market It’s the American dream to own a house, and there’s a list of gains that a homeowner has such as tax credits, equity building, and just the simple but joyful experience of finally having a house that they can call their own and customize to their heart’s desires. These advantages will be more appealing now that consumer confidence has risen. This is caused by a decrease in unemployment and an increase in wages. These favorable conditions may propel buyers to invest in the housing market. Reason #3: Strong demand for housing Based on the responses reported in the September 2017 REALTORS® Confidence Index Survey, buyer conditions were rated “stable” to “very strong” in all states. In the midst of low interest rates, rental appreciation, improving job market, and the general confidence in the economy, the demand for buying houses is strong in this time. There has also been a reported decrease in the expected number of days it takes to sell homes. In September 2017, it took just 34 days for properties to stay in the market. Reason #4: A spike in housing prices As mentioned in the previous passages, short supply tends to result in an increase in value. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. According to NAR, the median price of single-family homes sold in August 2017 is $255,550, which is 5.6% higher than a year ago. If you’re a seller whose property value dropped during the recession, you could benefit from these high housing prices. Reason #5: Renting is becoming less affordable Another thing that could benefit you as a seller is the rising rent prices. According to NAR, over the years, and in many parts of the country, specifically in the Northeast, South, and Midwest regions, it’s cheaper to buy a house than to rent one. This drives buyers to opt for owning a property rather than to have their money put into something that would not build their equity.

Read More12 Home Staging Tips That Are Designed to Sell

Staging your home helps you build that memorable first impression for potential buyers. You have to showcase your home's strength and downplay its weaknesses. Staging is also especially important in slow markets with high inventory and many competing homes. Heed these simple yet effective staging tips that may just help you close the sale. 1. Declutter, Declutter, Declutter Get rid of your old items and things you don't necessarily need. Give yourself a rule that when a new thing comes, the old one must go. Organize your shelves to show off how much storage you really have, as prospective buyers love homes with lots of storage spaces. Clearing away your clutter will definitely help make the house look tidier and bigger. 2. Place a Welcome Mat An enticing entrance is key when you're luring prospective buyers. A new welcome mat that complements the style of your home can easily convince them to see more. Remember, first impressions are always important. So adding fresh potted plants to an entry area could also create a relaxing atmosphere on the way in. 3. Swap Personal Photos with Artwork Replacing those personal pictures of yours and your family with pieces of artwork will help your potential buyers envision themselves living in your home. You can opt to buy paintings of landscape scenes, modern shapes or floral motifs at thrift shops to create a focal point for your home. You can also print out inspirational travel images to display a certain lifestyle. 4. Refresh With Paint Put a fresh coat of paint in white or neutral colors to give new life to outdated doors, walls, and casing. It will make the house look cleaner and more contemporary. 5. Give Importance to Home Lighting The secret to a great staged home that looks warm and welcoming is great lighting. Nobody wants to go in a house that projects a dim vibe just because it is improperly lighted. Increase the wattage in your lamps or fixtures and put them in key areas. Also open up windows and curtains to let the sunshine in and naturally brighten up the whole room. 6. Group Furniture Away From Walls Move away from the common idea that rooms will feel larger and be easier to use if all the furniture is pushed against the walls. Instead, reposition sofas and chairs into conversational groups and place pieces of furniture away from the walls. It will help make the space more user-friendly and make the room seem bigger. 7. Transform Old or Unused Rooms Repurpose an extra room into a space that will certainly add value to your home. You can turn that old junk room into a mini library with a comfortable reading spot by placing a bookshelf, a comfortable armchair and a small table. Or turn it into a yoga room or a mini entertainment hub. Either way, it will help the potential buyers envision the room with a special purpose that will suit their lifestyle. 8. Recycle Your Resources Look for ways to salvage old materials to save money. Repurpose old junk and turn them into something new and useful, like making headboards out of old doors or turning strips of hardwood flooring into new fences. 9. Arrange Decorative Displays and Group Them into Three's Assembling classy and colorful displays, such as vases, lanterns, books and other decorative items, atop dressers and counters could give your house a cozy and relaxing look. It will also increase the room's general appeal. Arrange them in odd numbers, preferably in three's, and in varying heights and shapes, while keeping them in the same color family. You can also try to mix and match items from craft stores to create a unique but modern look. 10. Decorate the Bathroom with White Linens Tidy up your washroom by using white towels, bath mats and shower curtains for that clean and elegant look. Take it a bit further by creating spa-like displays, such as adding candles, fresheners and special soaps. Stack hand towels neatly near the sink and complement it with other accessories. 11. Refurbish the Kitchen The first thing to do when staging your kitchen for homebuyers is to keep the countertops nice and clear. Put only a few items as displays, or center a bowl of fresh fruits or a vase with flowers to add a touch of color. If you can't afford new doors or cabinets, refresh the old ones with paint that match your kitchen walls. 12. Tend Your Yard and Improve Your Curb Appeal Curb appeal is important when attracting buyers, so bring out a nice color into your walkway that will make it more appealing. You can also grace your yard with potted plants and flowers in bloom, depending on the season.

Read More6 Of The Best Ways to Manage Stress When Selling Your Home

Whether it is your starter house or you've done it before, selling your home is one of the most stressful events in life. In fact, surveys found that selling a property is seen as more stressful than buying one. You can expect a lot of pain, anxiety and frustration as you go through the process. You may be dealing with solicitors and paperwork that seem to have no end. However, staying focused and positive as you navigate through this challenging phase is important. Take a deep breath and consider these simple yet useful ways to help you deal with the stress of selling your property. 1. Hire a realtor to sell your house. When you hire a licensed real estate agent in your area, you have every right to certain expectations and requirements. The realtor will guide you through various business arrangements that will help you be at ease. Avoid hiring a relative or a friend to list your home at all costs, as it may add more tension in between. The process of listing and closing is tough enough without you worrying about any personal relations being affected. 2. Declutter your home. Even before listing your house, get rid of the things you don't necessarily want to keep once you move. It will eventually help you clean and tidy your place. Never leave the dishes in the kitchen, keep up with the laundry and vacuuming, and clean the bathrooms thoroughly. If this is too much of a task for you, you may consider hiring cleaning help during this transition period. Keeping things tidy will help lessen the stress when you get a quick call from your realtor for a house showing for potential buyers. 3. Take a day trip or plan a vacation. You may not consider it at first, but planning that vacation as soon as you list your house will work wonders. It is because the first few weekends your house is on the market is typically when it is going to get the most action. Plan a day trip or an all-day activity, such as a visit to a museum or a weekend getaway. If you are not living there, your realtor can schedule open houses and showings at any time of the day. You don't have to drop everything to get out of the house for an unexpected showing. Think of this time as an investment on your personal well-being by getting your mind off the house sale for a bit. 4. Maintain a healthy lifestyle. One of the best ways to manage stress when selling your home is adapting and maintaining a healthy lifestyle. Get plenty of exercise and sleep, eat healthy foods and drink more water. Walk for an hour every day or take your kids to the park and have a valuable time together. Those extra efforts will keep you physically and mentally healthy despite this tedious process. 5. Prepare as much documentation as possible. Selling a house definitely involves a great deal of paperwork. Sometimes you’ll need to be ready to present all those documents at a very short notice. Preparing the necessary documents will save you tons of work and time as the selling continues. Get in contact with your solicitor, find your mortgage documents, and be certain you have copies of title deeds and other necessary papers, including energy performance certificates, planning permission documents, gas safety inspection certifications, and others. 6. Accept the facts and be flexible. According to HealthStatus, any disruption of your routine causes stress. Moving disrupts the entire family, and you also have to deal with the packing. The longer your house is on the market, the more pain and frustration you will need endure. Even after all the cleaning and preparations you've done, always remember that selling a house takes time. There’s a strong chance that your home won’t sell on the first open house so remember to have realistic expectations. This could help alleviate the stress you're already experiencing. Stay positive and trust on your realtor and the value they've provided to your home.

Read MoreThe Top 5 Realtor Review Websites That Most Successful Agents Use

As much as personal recommendations from friends and family are revered when it comes to real estate recommendations, people nowadays turn to the Internet for reviews including real estate agent prospects. Consumers have become more critical, and they want to get as much bang for their buck, so that means getting a good review on your service will upgrade your chances of scoring clients. Here's a list of websites you can use: Zillow is specifically made for real estate agents, and you get to have separate star ratings for several aspects like your negotiation skills, process expertise, local knowledge and responsiveness. Take note that the site gets a whooping 124 million visits per month! If you take this into account, it's safe to say that getting your share of leads through this site will be high. Included in the Zillow group websites that advertise realtors are Trulia and StreetEasy. Why it's good for you: The site has a feature that lets you be a Zillow Premiere Agent through which you can promote your listings, generate buyer and sellers leads, and even advertise on Facebook. This comes with a fee, but it gives you the benefit of exclusivity – you’re the only agent promoted on the page when you submit your listing, as opposed to not getting signed up as a Zillow Premiere Agent wherein other agents will appear on your listing – and wider reach, because even if you don’t have a listing of your own yet, you get to advertise on the local listings by non-Zillow Premiere Agents. What to watch out for: If you ask your clients to give a review, they would have to make an account in Zillow which might prove to be a hassle. Also, they do not have a clear description of how they filter reviews so it is likely that you might get a bogus review for your work. Another problem that clients encountered with Zillow is that home prices listed on the website are not always accurate. Yelp is a broad review platform which allows its users to give their take on restaurants, schools, and even realtors. The site has been around for a while, and it's been re-designed as a social networking site where reviewers can connect with fellow reviewers. Why it's good for you: Yelp is easy to use and navigate; you won’t need to stress over learning how to use a specialized website. Another great aspect of the site is that they try to ensure the integrity of their reviews through screening it first before posting it. It filters the bogus reviewers, and if one does come up in your page, you can request to have the review moved. What to watch out for: The robot that they’ve created for the website to filter reviews works on its downside too – their faulty algorithm could have half of legitimate and helpful reviews buried. Trulia helps its users not only find their home but it also helps them find real estate professionals such as brokers, agents, mortgage brokers and lenders, appraisers, and property managers through its extensive agent directory. Why it's good for you: Now that it’s owned by Zillow, you can have a wider reach. It also allows you to send a client listing report so that your clients can know how you’re featuring their home on Trulia. What to watch out for: There were complaints by realtors mentioning how Trulia promised them with leads from zip codes where the housing market was “hot,” but the site failed to deliver them this promise even after they have purchased leads. Realtor a site dedicated to real estate which enables their users to look for listings, to know details about mortgage, and to find realtors. Why it's good for you: Realtor.com has real estate articles popping out of google searches for when someone wants to know more about buying and selling property. And they almost always have a link on those articles leading to finding a realtor on their website. They also have rating categories for real estate agent’s attributes such as market expertise, communication, professionalism, negotiation skills, and responsiveness. What to watch out for: Some buyers may veer away from properties posted on this site because of the lack of information that could be featured on the site such as crime rates within the area. They also don’t feature photos of the property as much as other websites do. You can say that Facebook is oversaturated with all sorts of things, or that it can distract people away from your property. This is true to some extent, but it's also the first thing people check when they open their phones so the market is assuredly big. Why it's good for you: You can make your page as easily as you can have it noticed since everyone is on Facebook. You can pay to have your page advertised (it’s actually cheaper than you think!) or you can opt to have your friends and family share your page and have you easily connected to a web of people who could be potential clients. What to watch out for: If you do use Facebook as a website for getting clients, it’s advisable to have other websites in tow – specifically websites which are mainly used for selling property - since Facebook may cause limitations in terms of presenting the full range of what realtors have to offer.

Read MoreFrom Renter To Owner: 8 Important Reminders Before Making The Transition

If you're renting now, you most probably dream of having your own house one day. In fact, you’re probably already looking into buying a property to your name right now. So aside from finding that perfect dream home, what else do you have to prepare for in buying your own place of residence? Here are 8 important reminders before making that renter-owner transition: 1. Make a Realistic Renter-to-Owner Timeline After the tedious task of searching and even after your seller accepts your offer, you may think that the job is done. You're move-in ready! Not just yet. Be reminded that it may take around 30-50 days to close a home. You have to make sure that you time it right with the end of your lease. You don’t want it to be a renter-homeless-owner story! 2. Know the costs associated with homeownership Costs, costs, costs! There’s a lot more to pay for upfront than just a security deposit as a renter—from deposits, home loan origination, title insurance, land surveys, home inspection, insurance escrow, appraisal, among others. Then, of course, you have to consider mortgages, home association dues, etc. in the long run. 3. Study Rent-vs. Buy Math More costs mean more math. This will be more than just rental payment vs. P.I.T.I. A more accurate comparison will also include after-tax-benefit homeownership costs and rent costs. 4. Know Your Tax Benefits With all these costs, don’t worry, your tax deductions will significantly lower the costs of homeownership. Mortgage interest and property taxes will be deductible in filing annual tax returns, and reduce your taxable income. 5. Start preparing your credit score now In getting the best mortgages, credit scores are very important. Those who lend want reliable and on-time payers, after all. If you only have one credit card, start getting more now, while you have time to grow your credit score. More credit accounts are seen as better. 6. Research mortgage options You can’t only shop for the best-fitting home for you, but also the best-fitting lender too. Compare rates of your mortgage based on your loan type, location, purchase price, down payment, and as mentioned earlier, credit history. 7. Prepare for more responsibilities These include maintenance issues from the roof of your home down to its very foundation. Set up insurance and even an emergency fund for these responsibilities. 8. Think long term Consider the fixed features of the home such as location, think of the things you may want to alter in the long run, even take note that the neighbors you will have in this new home may be your neighbors for life, and if need be, think about the property’s resale value.

Read MoreHow To Deal With Low Ball Offers On Your Home

You might have expected that your house would sell for exactly what you set the price for, and a buyer making an offer for much less could be pretty frustrating. So what exactly makes for a lowball offer? Typically its 25 percent or less below list. But with all things being unequal, what makes an offer a lowball may vary from market to market and price range to price range. You could know off the bat when an offer is just downright ridiculous, but it's still best to not let your emotions get the better of you and consult with your agent because they might have a better gauge and understanding as to how offers go. It’s tempting to block off further negotiation with buyers who make such offers but remember to keep your calm because after all, you are engaging in business. It could be that your buyer may have just gotten bad advice from people around them on how they should price their offer, so it’s still advisable to keep communication lines open. The offer may have not started on the right foot, but tables can be turned if you just know how to negotiate. Don't waste your time thinking how you might be perceived. Consider all offers with a cool head and you might end up with a good deal. You can have your agent ask the buyer’s end on their reasons for making an offer lower than the asking price. Knowing their answer could actually be beneficial to you; you could view your property using a different lens. Are there parts in the house that needs fixing? Has the house been for sale for longer than the ideal time? Knowing the answers to questions such as those would help you evaluate just what you need to improve on it so that it could look more appealing to the market. A trusty and experienced agent could spot when a buyer – despite making a low offer – is smitten with the house and are willing to raise their offer. If you're going to make a counter offer, it’s best to present it with data such as a market’s list-to-sales price ratio. Also, you can have your agent make a written document containing the best comparable homes to yours. Include the following statistics from two months ago to the same measurements today: a.) Number of similar homes on the market. b.) Number of similar homes sold and closed since the listing’s inception. c.) Number of listings that expired unsold. d.) Number of pending transactions. e.) Number of new similar listings (your competition) with the data sheets and pricing By knowing all these information, you would have an wise estimate on the lowest and highest price you can expect.

Read More10 Important Fixes/Repairs To Make Before Selling Your Home

If you're about to sell your home, having it in top shape will definitely up your chances of getting it sold quickly. It shouldn’t just be about making it look beautiful; you have to consider functionality as a major aspect in a buyer’s decision. A buyer will most likely have a professional home inspector check for faults in your home, so it’s advisable for you (with the help of your agent) to address problems beforehand. 1. Paint – Doing this will instantly revamp your home, and it's one of the most cost-effective methods into making your house look appealing to buyers. Light-colored, neutral tones make your rooms look more spacious and it also makes it look as if it’s blank canvas, where your buyers can help picture how they want it to look once they move in. 2. Kitchen – The kitchen is one of the most functional spaces in a home. You don’t have to stuff it with new appliances to make it look like a dream kitchen, but just make sure to address problems regarding usability. Leaking faucets and old sinks must be repaired, and the dishwasher or range that is out of shape should be replaced. Also check if hinges or tracking in your drawers and cupboards need fixing. 3. Flooring – No one wants to live in a home with sub-par flooring. Buyers prefer hardwood floors, so if your house has that and it’s in good condition, make sure to make it known by removing carpeting. But if you don’t, there are a number of low-cost options such wood plank tiles or highly upgraded laminated flooring. 4. Bathroom – Just like the kitchen, the bathroom is a very functional space in a home. Check for leaky faucets and if necessary, replace caulking in the areas like shower, sink, and toilet to help in keeping the moisture out. Also keep in mind that making it clean goes a long way. Have the toilet as white as possible, and have your grouts steam-cleaned. 5. Roof – If your roof is in bad shape, it’s advisable to cater to this before you set your house up for sale so that renegotiation and price reduction won’t be on the table once a buyer makes an offer. 6. Exterior – Your curb is where buyers get a first impression of your home. Include fences in your paint job, patch up cement cracks in sidewalks, and resurface asphalt driveways if necessary. If you have extra cash to spare, add in bright flowers and plants to spruce up your curb. 7. Lighting – The lights sets the atmosphere of the home – the brighter they are, the more enticing and welcoming your rooms will look. Make sure that lights are working properly both on the exterior and interior of your home. Don’t forget to check if your switches work, too! 8. Air conditioning and heating systems – As mentioned previously, your home may most likely be subject to a house inspection so it’s good to get ahead of them and take care of minor repairs. Having this in top shape will definitely give you an advantage over other sellers. 9. Plumbing – Your house may look good in terms of its aesthetics but if there’s problems in the practical aspects of the home, buyers might step back. You can tend to minor fixtures yourself but if you want to be assured that the plumbing is in a good condition, hire an expert to inspect and fix. 10 . Knobs – They may seem trivial but buyers could be critical of everything. If something as basic as a door knob is not working, buyers might think that the more important parts of the house are not working too.

Read MoreThe 5 Biggest Red Flags To Spot When Purchasing A New House

Whether it's your first time buying a home or have had experience in purchasing properties, it’s very important to be reminded of what can be a problem after the sale has been made. After all, we want to minimize costs and get the best deals. How can this be done? Home inspections are crucial in the process of house hunting. Sure, the house is charming and homey, but there might be some cracks and rotting that are signs of major damage. Here are five of the biggest red flags to spot: 1. Any Foundation or Structural Issues Cracking is one of the biggest signs to watch out for in terms of foundation problems. Cement settling, for example, may be indicated by small cracks in the basement. Larger cracks on the other hand, may be a symptom of structural integrity issues of the home. You may also take note of unfit doors. If you have a hard time closing and open doors in the house, this may mean a larger structural issue. Specifically, check if the door fits squarely in its doorframe. 2. Pest/Insect Problems Aside from sending shivers down your spine, having pests in your home may also mean wood destruction. The most common pests you should look out for are termites, powder post beetles, and carpenter ants which may damage your home. 3. Random Freshly Painted Walls Freshly painted rooms are normal because this makes the property feel clean and fresh. But if only one wall or area of a room looks freshly painted, this may be a sign of the seller trying to cover up a problem. This is automatically a cause of concern, and you should ask about it right away. 4. Amateur Workmanship or Repairs The older the home, or the longer a family has stayed in it, the more repair work the previous homeowner or another amateur may have done. You will most commonly see this in areas of plumbing, carpentry, and electrical work. It is best to watch out for leaky faucets, toilets, missing trim work, and other potential do-it-yourself/handyman projects in doing home inspections. 5. Neighborhood Remember, in purchasing a home, you are not only going to live in the specific lot, you will also be living in the neighborhood. If a house seems perfect, and do not have the above red flags, make sure that it also has a neighborhood with an overall good condition. How do you know this? Take note if there are a lot of vacant lots in the area, and if the other houses are boarded up. If you can, also check the crime rate in that particular area—is it increasing or decreasing? This may not only affect your stay in the home, but also the property's resale value in the future.

Read MoreThe Complete Home Sellers Checklist (Exterior Preparation)

Before putting your house on the market, make sure that the exterior of your home has the best chance of passing the standards of even the most meticulous visitors. It may seem like a daunting task, but don't be overwhelmed. We made this complete checklist to help you get the job done.

Read More10 Important Things To Know Before Listing Your House For Sale

Putting up your house for sale puts you in a place of responsibility as the owner, because of course; we all know that earning profit is not that easy. But rest assured that after this experience, you will have gained more skills, insights, and tricks! 1. Do your homework: research on the price range of properties in your area – Doing this saves you from overpricing or under pricing your house. Look into houses within your area that are of similar feature to yours in terms of lot size, number of bedrooms, bathrooms, and parking capacity. If you have time to spare, visit these homes yourself during their open houses. Checking competition will also help you evaluate not just the right price for your home, but also things that you could improve on your house to make it look more marketable. 2. Make your house market-ready – With all the available (free) information for everyone today, buyers have higher standards in choosing a house. They may have envisioned the perfect home on their mind through browsing magazines or photos on Instagram or Pinterest, and it would be of an advantage to your property if you at least try to make it look as if it's straight from their dream. If you’re willing to spare extra cash and effort, you could hire a team of professionals composed of a home stager, landscaper, painter, and handyman. Just make sure that you account these expenses for your final pricing. No budget? You can opt to go DIY. Also, the cheapest way to make your home market-ready is to make sure that it’s clean and free from clutter at all times. 3. Hire a reliable agent – You shouldn’t just hire an agent from a pool of names and faces listed in your directory; ask trusted friends for referrals on agents and interview them before hiring. Ask the right questions to your prospective agent so that you know how selling your house will be handled. 4. Have a professional inspect your house before pre-listing – Buyers might make their offer contingent upon certain inspections such as pest and septic, so it might be a good idea to hire a professional home inspector in order to tend to the issues you may not have spotted on your house. Ask for a detailed report from your home inspector and have them include photos for proof. 5. Any season is a peak season for selling a house, except winter – As most people are busy with Holiday errands and out-of-town, out-of-country trips and social gatherings, there wouldn’t be much buyers on the hunt for houses. You could put your listing on hold until spring comes, but if you’re taking your chances, you could still try during winter, as there are also fewer sellers. That means less competition! 6. Prepare necessary documents – Your agent will notify you of the necessary documents needed once the selling transaction begins. This may include documents on title of property and outstanding balance on mortgage (if any) & pay-off balance. Gathering these documents ahead of time will ease the way for a faster transaction. 7. Yup, it may not sell like hot cakes – Despite countless preparations (including the emotional one) and seeing your house as The Best Ever in the Market, it may not sell as quickly as you thought and wanted it to be. Relax, a house is a huge investment on the part of the buyer, and they may be nitpicky on the average and flaky at worst. 8. You could be your own salesperson, too – Don’t rely solely on your agent to do all the marketing – you could ask a photographer friend (or if you know how to take good photos yourself) to capture your home as beautiful as possible. You could use social media to your advantage by putting up ads on Facebook and Instagram (it’s actually cheap), or just by simply posting it in your social media accounts and asking friends and family to share it. 9. Have a gauge on your potential profit (or loss) – Reduce the selling price to the following expenses that will be incurred throughout the selling process: Title charges Government recording and transfer changes Real estate agent sales commissions Additional settlement charges Debt obligations that needs to paid off on an ongoing mortgage Home repairs and enhancements prior to listing 10. Research on current tax laws – You could have your agent explain this to you as they may be knowledgeable and updated on tax laws, but it's good to also do some research on your own. It could also help you when estimating your potential profits after selling.

Read MoreBeware Of These 3 Home Insurance Purchasing Mistakes!

A homeowner's insurance is a type of property insurance that covers a private residence and its’ assets when losses and damages occur. Once a house is insured, it is typically protected from four incidents: interior damage, exterior damage, loss or damage of personal assets/belongings, and injury that arises while on the property. Whether you’re a first time home buyer or not, mistakes can be made. It may cost you a lot if you fail to carefully pick the insurance that’s right for you. We’ve round up the list to 3: 1. Not understanding exclusions – Every home insurance has exclusions and it's important that you know which kinds of damage your insurance doesn’t cover. Damages from flooding and earthquake are usually not covered if you’re not located in a coastal area or near a fault. But remember that inland flooding can occur from ground water, as with the case in New Jersey, New York, and Vermont during Hurricane Irene. As for earthquakes, damages in your house may still occur once it hits even if you don’t live near a fault line. It’s also important to note that most policies don’t cover mold and sewage backup, which often happens after a heavy downpour. Mold insurance can run up to $300-$400. It’s advisable to add this in to your insurance if it’s an old home you’re eyeing (and if it isn’t built with mold resistant materials) or if your area is humid. Sewage backup on the other hand only costs about $40 per year so it wouldn’t hurt to add that in, too. 2. Underinsuring your home – Once a disaster hits and your home needs rebuilding or your valuables need replacing, your insurance should be able to cover up these costs. A mistake commonly made by homebuyers is that they buy only enough insurance to cover their mortgage. Even an amount equal to the current value of the home may not suffice once a house needs rebuilding, because labor and supplies may need to be factored in. Ask help from your agent for the average rebuilding cost per square foot in your area and see if your coverage is close to that figure. Another smart move is to make an inventory of your valuables such as art, jewelry, furniture, antique -- gather your receipts and take photos of the items, then you may schedule an endorsement to raise your limit for contents coverage. 3. Setting the wrong deductible – The deductible is the amount of money that you pay toward a claim before insurance pays. Be careful to not set it too high or too low, for choosing the former may have you paying for more and your insurance paying for less (or not at all!), and by choosing the latter you may have to pay more than you should for premiums each year. Consult with an expert so that you could make the best decision.

Read MoreA Complete Guide To Closing Costs

First-time buyers may not be aware of the long list of fees under Closing Costs. Buying a house is a big investment and a tedious process, but we've got you covered on the details of these expenses – what they’re for, and how much they usually cost. In this article, the closing costs are divided into three categories: Lender Fees, Insurance Fees, and Title Fees. Lender fees Within three days of receiving your application, your mortgage company has to give you a Loan Estimate which itemizes estimated interest rate, monthly payment, and total closing costs for the loan. Here are some of the fees that could be included in that list: · Loan Origination Fee – This is the fee for generating and processing your loan. The rate is usually 0.5-1% of the total loan amount. · Discount Points – Basically this is for when you want to buy an interest rate. The amount of this depends on what rate was initially given to you and what rate you want to apply for. Note that this may be optional. · Processing Fee – This is for submitting and gathering your loan application. Usually this costs less than $500 in the United States. · Appraisal Review Fee – A professional appraiser will check the property for its market value. Lender require this to make sure that the house is actually worth what was declared in the contract. · Credit Report Fee – A credit report is a detailed account of your credit history and your credit points. Lenders require this for qualification purposes for the loan. Usually it's the lender’s company themselves who order this from a credit report bureau. · Courier Fee – Lenders employ couriers to deliver documents during the transaction. Some lenders will put this under the processing fee. · Underwriting fee – This fee is for a series of steps that evaluate your loan application, like verifying the documents that you have passed, checking if the appraisal on your house is consistent with comparables, and assessing whether you income level is at par with your liabilities. · Documentation preparation – Once the underwriting approves your loan, legal documents and miscellaneous such as the mortgage note and deed of trust should be prepared for closing. · Wire transfer fee – This is the cost for wiring funds to an escrow company. Title Fee · Recording Fee – This fee is for recording the deed and mortgage at the local court house. The amount for this fee depends on the number of pages in the document · Notary Fee – Documents such as the deed of trust must be notarized by a registered Notary Public before it can be recorded at the court house. This amounts to usually $10. · Title Insurance – This is protection for you as a buyer to make sure that the title is clean and that no contentions will be made against you as the new owner of the house. This may be optional. · Escrow fee – This is paid to the escrow company or the attorney who made the closing. This is usually a split expense on the buyer and seller. Insurance · Private Mortgage Insurance (PMI) – This is required by lending companies if you made a down payment below 20%. When the deal is closed, this expense will be rolled into your monthly mortgage payment. · Homeowner’s Insurance – This financially protects the property and its contents from disasters such as fire and theft. Most lenders require 1/6 of the amount of this to be put into an escrow account at closing. · Flood Insurance – This will be required from you by the lender if the house is located in a flood zone.

Read More3 Important Questions You Must Ask A Listing Agent During An Open House

Open houses are a good opportunity for you to meet personally with the seller and their listing agent so take advantage of this moment to get the details that will help you decide if you will push through with making an offer or look elsewhere. Here's 3 questions you definitely need to ask as a prospective buyer: Buying a house is probably the biggest investment you'll ever make and it’s best to be critical on where you could possibly put a big amount of your money and time on. Open houses are designed to please your senses – there’s fancy lights, newly-painted walls, fragrant candles, you name it! But there might be issues on areas you can’t spot right on such as issues with the roof (ask what material the roof is made of; tile and slate roofs last 50+ years, while asphalt shingles last 15-20 years), wiring, sewage, drainage, heating and air-conditioning systems etc. You can opt to do the investigation yourself while touring the house, and if you’ve spotted issues that the listing agent did not disclose upon your asking – low water pressure, dripping sinks, subflooring covered by a fancy carpet -- that might be a sign to step back. Also ask if the home appliances and systems are covered by a home warranty. Keep in mind that it is required by the law for sellers to disclose to buyers any code violations or structural issues. You can ask for written seller’s disclosure and take photos of problem areas so you could review them when you make your offer. You can find this information on your own but asking the listing agent can put the information in context. If it's been on the market for a long time, you could have more bargaining power. But it could be that the sellers had a previous transaction with a buyer whose financing fell through. In the case where the house has been on sale for only a short while, there might be a sling of buyers expressing interest. The information you get will be useful when you make your deal. It's good to know information about people you will be surrounded with for a good lot of time in your family’s life. Ask details that correspond to your lifestyle, like if the neighborhood is kid-friendly, or if it’s congenial to retirees. Also ask about nearby schools, hospitals, police and fire stations and make your own research on their credibility and efficiency.

Read More3 Important Questions To Ask Before Choosing A Real Estate Agent

Hiring an agent is a must if you're off to sell your property. Of course you want to be represented by someone who’s competitive and is also trustworthy and easy to communicate with, since an agent will have access to information about your finances. You may ask for recommendation from friends and family, or look up online. Once you have a list of names, call them up for an interview. Here’s 3 important questions you should ask: Experience is the best teacher, especially for this kind of job. An agent that can't sell will not last long in the field since their earnings are commission-based. It’s ideal to hire someone who has years of experience under his or her belt – they’ve bulked up their contacts, are more prepared to handle situations when faced with conflict, and are better communicators and organizers. Ask for their history of sales over the past 6 months and the areas that they’ve covered. This will help you gauge how competitive they are and how much they know about the market, which are both deciding factors in choosing an agent. Although experienced agents are the better option by default, novices have good things going on for them too. They’re definitely eager and enthusiastic to make that sale. Ask if they’ve been under the wing of a mentor and look up the credentials of that person too. Newer agents will tend to have more time to cater to you since they probably don’t have a string of clients just yet. This will help you determine if your prospective agent has time for you. If she is working with a dozen other clients, ask her what her strategy is in juggling all of you while still delivering the best possible work. Also ask if she has a team on her side to help her. In line with this, ask for references from past clients. They will of course give you contact to a client with which they had a smoothest transaction with but it's still best to know firsthand how their experience with the agent went. This will test if your prospective agent is adamant on selling your property. If she asks for things such as details on the property, what your preferred marketing strategy is, what your timeline is in making the sale, your preferred mode of communication and available hours, it's an indication that she is making way for a client-centered transaction which works best to your advantage.

Read MoreFirst-Time Home Buyers, Are You Making These 7 Mistakes?

It's easy to fall in love with your dream house (and the idea of finally buying one), and we all know that when you’re as enamored as you are pressured to take a big leap, your judgment could be clouded. Remember that stakes are high when you’re purchasing a house, so here’s a list of major mistakes you should avoid doing at all costs: 1. Underestimating (or forgetting) the added costs Buying a house entails a list of expenses other than the price of the house itself. There are loan application costs, mortgage insurance, and closing costs, to name just a few. You may also need to spend on several renovations once you move in. One tip: a fourth (or better, half) of the price of the house should be stashed in your account in order to cover for these expenses. 2. Not getting a buyer's agent Getting an agent who will represent you as a buyer could give a more critical eye to deals and transactions, as opposed to negotiating solely with a seller’s agent who’s legally obligated to work for their client’s interests. 3. Falling prey to “too good to be true” home values These advertised low rates are all over the internet, and online home valuation sites can set unrealistic payment expectations. It’s good to have an experienced real estate agent explain the rationale on market prices through a conducted comparative market analysis based on internal industry data. 4. Not doing research on the neighborhood You might have found the house of your dreams, but hey, it doesn’t exist in a bubble. It’s best to know about the status of the location of the house in terms of the ease of transport around the area, the crime level, presence of earthquake fault lines, proximity to schools, hospitals, and police stations, etc. 5. Going house hunting without a pre-approved mortgage Getting pre-approved for a mortgage plan requires a professional evaluation of your credit report and credit score, which puts you in place in terms of your finances: how much could be lent to you, and how much you could afford to regularly pay. 6. Skipping home inspection A house could look like it’s in top shape but it’s not impossible that it has some share of defects. A certified home inspector with a trained eye can spot problems which you could miss like termite infestations and gas leaks. If significant issues are detected, you may negotiate with the buyer to lower the price. 7. Failing to see it as a long-term investment It may be appealing to you to own a great house, but there are also a lot of things to consider. Ask yourself first if you could stay and work around that location for more than 3 years, and if your family could live a peaceful and thriving life in that neighborhood. If the answer is no, it would most likely be that you’re only throwing around your hard-earned money and effort.

Read More

Categories

Recent Posts